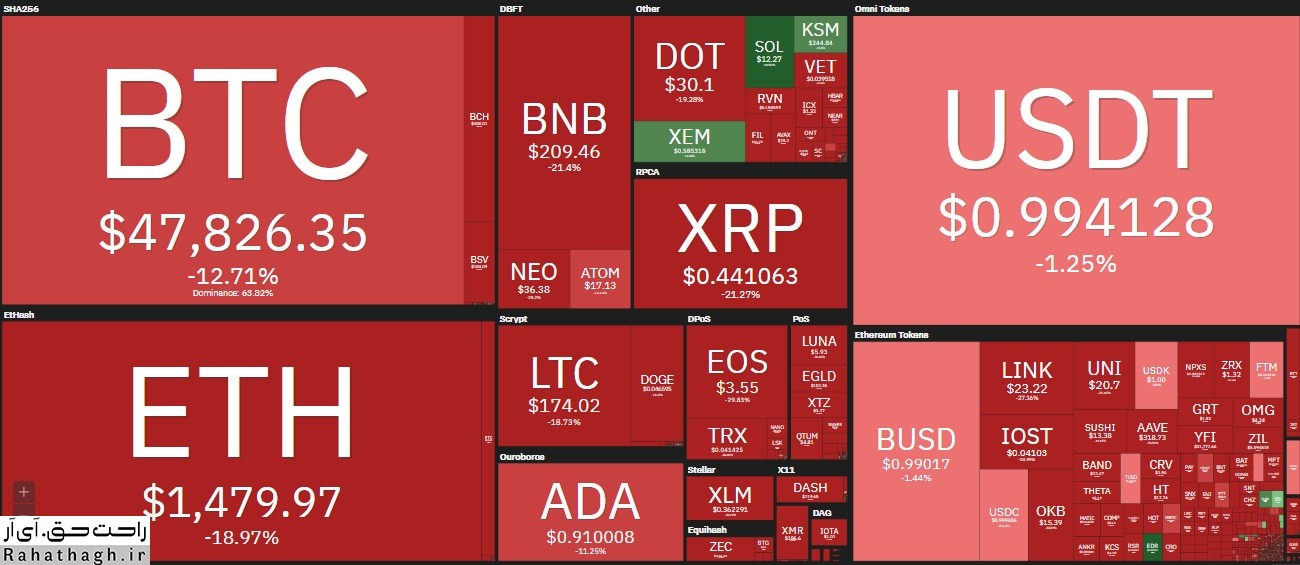

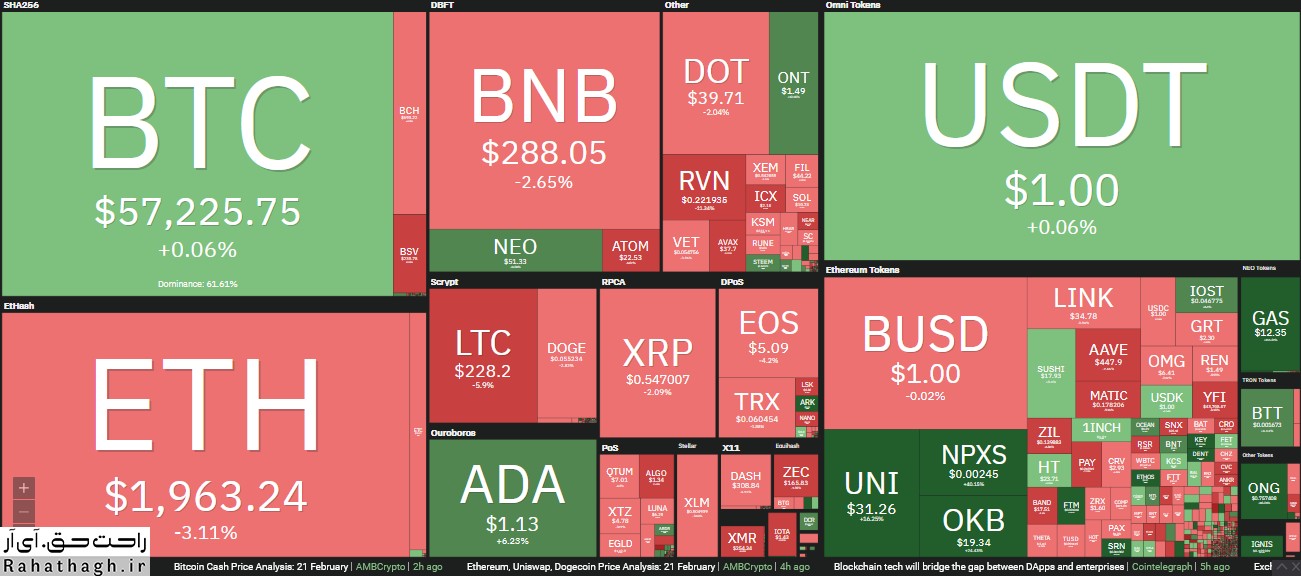

An overview of the cryptocurrency market Sunday, February 21

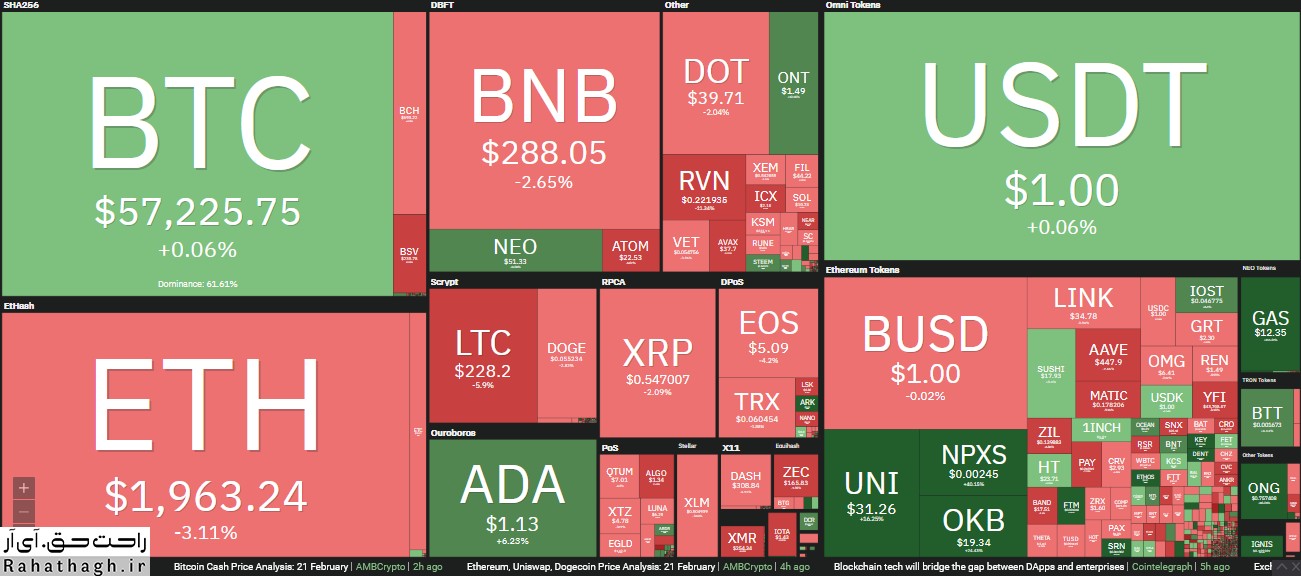

The currency calmed down to about $ 56,000 after the last bitcoin price hit a record high of $ 57,500 and then reached $ 54,000 with a sharp correction. Most replacement coins have also been declining over the past 24 hours.

Bitcoin settles at $ 56,000

Last week was a good week for the market's top cryptocurrency as it was able to offset the loss from the recent fall of $ 46,000. In the following days, the asset set a new record with a price increase of more than $ 11,000.

These developments led to the beginning of the last significant rally of this currency. The uptrend started at $ 55,000 and ended at levels above $ 57,500.

As is sometimes the case in the world of cryptocurrencies, this record was followed by a sharp drop in price to $ 54,000 in most cryptocurrencies, but Bitcoin managed to get out of this correction immediately and is now priced at around It will be traded for 56 thousand dollars.

The market value of the BTC mark has remained at $ 1 trillion, while the dominance of this asset in the market has slightly increased to 61.5% because most altcoins have turned red in the last 24 hours.

Blood bath in the Altcoins market

Over the past few days, most Altcoins have begun to grow; Of course, none of them may have grown as significantly as Baines Coin (BNB). The cryptocurrency gained three-digit growth in the last seven days, setting a new record at around $ 350. It is interesting to know that less than a month ago, BNB was trading at $ 40!

Yesterday, the local currency of Bainance Exchange started a corrective process and lost almost $ 100 of its value and reached $ 260. Atrium fell 4 percent after failing to close its daily candle above the $ 2,000 milestone. Ripple (7.5%), Light Coin (8-%) and Bitcoin Cash (8-%) are also red.

Polkadat reached a new record above $ 40 yesterday and for a short time even replaced the BNB among the top 3 currencies in the market, but has since stopped and is now trading below this level. Cardano (ADA) also rose 6 percent to $ 1.12.

However, on the 24-hour UNI scale, with a 25% increase, it saw the largest price increase among high-value altcoins. As a result, the Uniswap dominance token hit a record high of $ 32 earlier today. Thus, this asset became the twelfth largest cryptocurrency in terms of market value.

The situation has been slightly better between lesser-valued altcoins. The Pundi X tops the list with a 55% price increase, followed by Flow (20%), Voyager (19%), BitTorrent (17%) and Ontology (14%).

Quant, on the other hand, had the biggest price drop of 13 percent. Ren (-11%), Solana (-9%), Monero (-9%) and EOS (-9%) are next.