What is the dollar index?

The US dollar index consists of the geometric weight average of a basket of foreign currencies against the dollar. This is very similar to how stock indices work in that it provides an overview of the value of a portfolio of securities, the securities we are talking about here are other major currencies.

Basket

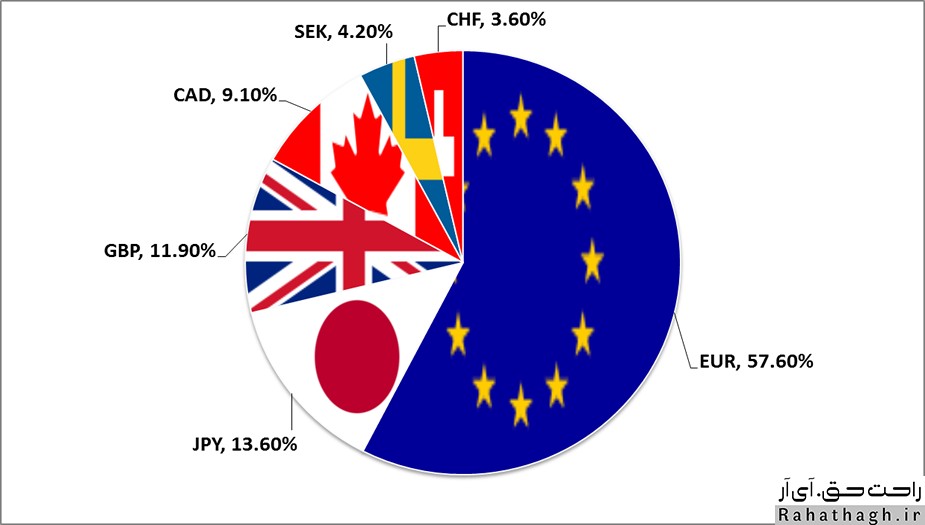

The US dollar index consists of six foreign currencies, which are:

Euro (EUR)

Yen (JPY)

Pond GBP

Canadian Dollars (CAD)

Krone (SEK)

Franc (CHF)

There is an interesting question here, if the index is created from 6 currencies, how many countries does it include?

If your answer is 6 you are wrong.

If your answer is 22 you are a genius.

There are 22 countries, as there are 17 EU members that have adopted the euro as their currency, plus five other countries (Japan, Britain, Canada, Sweden, Switzerland) and their associated currencies.

It is clear that 22 countries make up a small part of the world, but many other currencies follow the US dollar index very closely. This makes the USDX a good tool for measuring the global strength of the US dollar.

USDX Components

Now that we know what a portfolio consists of, let's get to the (geometric weight average) section. Since not all countries are the same size, it is fair to give each one a proper weight when calculating the US dollar index.

In 17 countries, the euro is a large part of the US dollar index. Next is the Japanese yen, which makes sense because Japan is one of the largest economies in the world. The other four countries make up less than 30% of the USDX.

Here's something interesting: When the euro falls, which one might cause the US dollar index to move?

The euro is also a large part of the US dollar index, we can call this index (anti-euro index). Since the USDX is strongly influenced by the Euro, people are looking for the dollar index (they are the most balanced). More information is provided below, first let's look at the charts!

Use USDX in Forex

How do you probably think I can use the dollar index in my trading system? Well be patient, we all know that many highly traded currency pairs include the US dollar, such as EUR / USD. USD / JPY. USD / CHF. GBP / USD. USD.CAD, in fact, often USDX provides a better picture when the market outlook for the US dollar is unclear. In the wider world of Forex, the USDX can be used as an indicator of the strength of the US dollar, since the USDX is more than 50% formed by the euro area and is quite inversely related to the EUR / USD.

This is like a mirror image! If one goes up the other is likely to go down. If the USDX is making significant moves, you can almost certainly expect currency traders to react to it. In short, currency traders use the USDX as a key indicator for the direction of the USD. use.