Weekly Gold Analysis Monday, March 1

Last week, the price of an ounce of global gold fell close to $ 100 and fell to $ 1720. This is the lowest price in an ounce of gold in the last eight months. According to the weekly assessment of Kitco News, it seems that from the point of view of market professionals, the decline in the price of an ounce of global gold is not over yet. In the coming week, all eyes will be on changes in the rate of return on Treasury bonds and the US dollar. Recently, the yield on 10-year US Treasury bonds has risen to more than 1.6 percent.

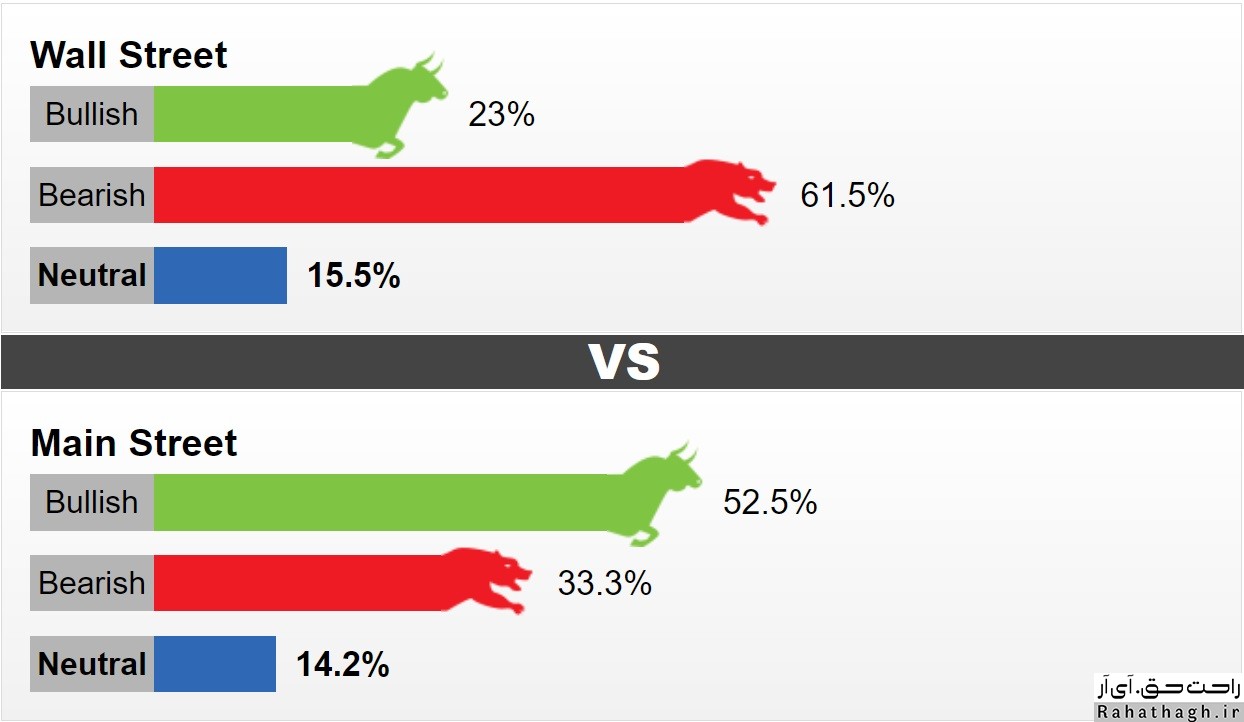

This week, 13 Wall Street activists took part in the weekly evaluation. 61.5% predict that this week's trend of global gold ounces will be declining. 23% of participants also predict that the short-term trend of global gold ounces will be upward. The remaining 15.5% expect a trend-neutral or neutral market. Meanwhile, 669 Main Street investors took part in the online poll. 52.5% were in favor of an uptrend, 33.3% were in favor of a downtrend and 14.2% were in favor of a trend-free market. This is the lowest level of micro-investor participation in an online survey in the past year. According to market analysts, the key support for global gold is at $ 1,700, and the continued decline of the market depends on the reaction of gold to this support.

Perspectives of Gold Market Professionals (XAUUSD)

Colin Cieszynski Senior Market Strategy at SIA Wealth Management

"The US dollar appears to be making up for recent declines, especially as investors focus on increasing Treasury yields." The price of an ounce of global gold is inversely related to the value of the US dollar. This means that the strengthening of the US dollar is to the detriment of the global ounce gold price.

Marc Chandler is the CEO of Bannockburn Global Forex

The recent bullish ounce of global gold has disappeared and the price of an ounce of global gold has fallen below the simple moving average of 20 days. The rise in US Treasury yields has hurt gold. XAUUSD's next target is to correct 61.8% of Fibonacci near $ 1,690. I doubt the market will move in this direction in the medium term. However, I will not be surprised by the neutral and wide fluctuations of the gold market. "

Adrian Day, President of Adrian D. Capital Management Company

"Next week you can see the latest efforts of sellers in the market. From a fundamental point of view, the situation is in favor of ounces of global gold, especially since there is a lot of liquidity in the world. The dollar index has only recorded an upward jump in response to the recent price peaks, meaning that the dollar index is still declining. In the US bond market, while long-term bond yields have risen, short-term bond yields are still low and the real interest rate on the US economy is negative. "Most importantly, the market needs a strong one-sided move to change the expectations and inclinations of investors."

Mark Leibovit Editor-in-Chief V.R. Metals / Resource

This professional activist is most pessimistic about the future of the gold market. He believes that the price of an ounce of global gold may fall as low as $ 1,500. "There are a lot of buyers in the market. The technical situation of the market is either neutral or declining. "So can the market fall to $ 1,500?"

Ole Hansen is a commodity market strategist at Saxo Bank

"For the first time in four weeks, I expect the global ounce price to rise." He attributed the optimism to gold prices to the US stock market reaction to the rate of return on Treasury bonds. "Increasing the rate of return on treasury bonds has also affected other financial markets. This means that investors will soon start thinking about buying safe and secure assets. The Fed's views are likely to be challenged in the coming weeks (Powell did not take the rise in Treasury yields seriously, saying the increase was due to optimism about the US economy, not inflation expectations). The US economy can not tolerate high rates of return, and the resurgence of bond yields could make investors think that the US Federal Reserve may have to control the yield curve in the near future. In that case, the real rate of return and the value of the US dollar will fall and the price of an ounce of global gold will fall sharply.