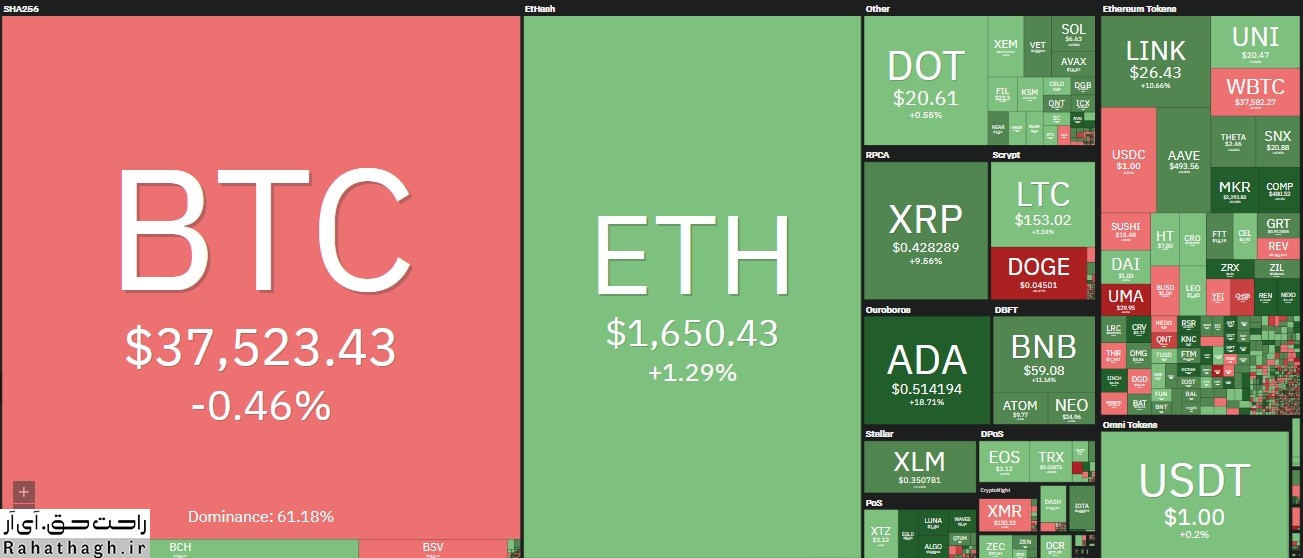

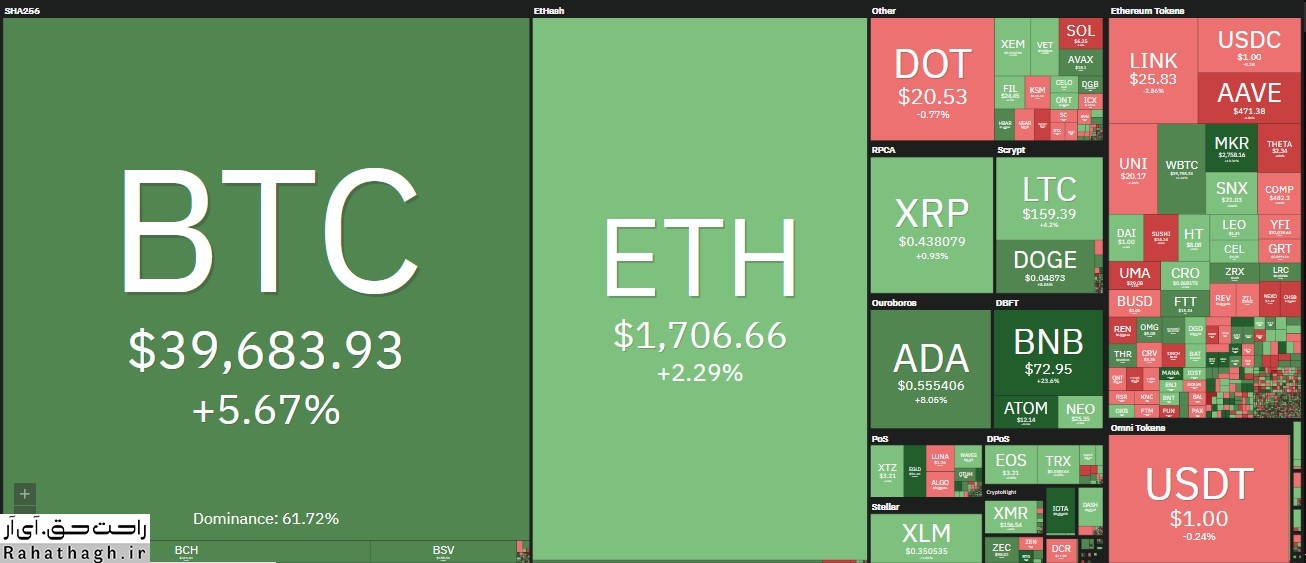

An overview of the cryptocurrency market today

The crypto market took a big step forward with the entry of Ether into the $ 1,700 channel and its all-time high of $ 1,773. Atrium futures trading in the Chicago Mercantile Exchange (CME) Group is scheduled to begin on February 9, which is why many analysts predict that the Altcoin will move to serious resistance on its way to It will reach $ 2000.

Ether is currently trading at $ 1,669, up 1.27% in 24-hour timeframe. Meanwhile, the market's top cryptocurrency, Bitcoin, traded up 5.24 percent over the past 24 hours at $ 39,268.

Gas costs in the Atrium network also reached the highest level in history at the same time as the price increase and caused some exchanges to suspend the ability to withdraw ETH and ERC-20.

On February 4, Yern Finance (YFI) was the victim of a massive attack, and a hacker removed $ 11 billion worth of StableCoin DAI from the DAI coffers. The team took swift action to reduce the damage. These include blocking the $ 1.7 million stolen budget and making a targeted proposal by the MakerDAO community to create a debt-for-collateral position (CDP).

Altcoins on the growth path

While Bitcoin traded in the range of $ 36,000 to $ 38,000, Altcoins accelerated and on Friday a large number of Altcoins saw a bullish decline in their price.

MakerDAO (MKR) grew another 45% to $ 3,099 before modifying to $ 2,810, while the Defy 0x (ZRX) Infrastructure Protocol rose 61% to $ 1.63.

Cardano (ADA) showed the most prominent performance among the larger altcoins with a 26.44% increase. Baines Coin (BNB) also reached its highest price at 64.87.

The total value of the cryptocurrency market today stands at $ 1.17 trillion, while Bitcoin dominates 60.1%.