Weekly Gold Analysis at Kitco Tuesday, March 16

According to Kitco News, expectations of market participants appear to be changing, and pessimism about the future of the global ounce gold price has eased. The price of an ounce of global gold was able to maintain its position above $ 1,700. Some analysts believe that the XAUUSD market has formed a short-term price floor. As gold prices return from a 10-week low, the optimism of small investors has been boosted by the rise in gold prices. However, market professionals are still pessimistic about the future. This ambiguity has been created in the expectations and desires of micro-investors and professional activists after the rise in crude oil prices and the approval of the US government's financial and support package. Many analysts have said that the US government's financial support package will support the global ounce price of gold in the long run. Others, however, expect the US government fiscal package to drive strong stock market growth and Treasury yields (to the detriment of the gold market).

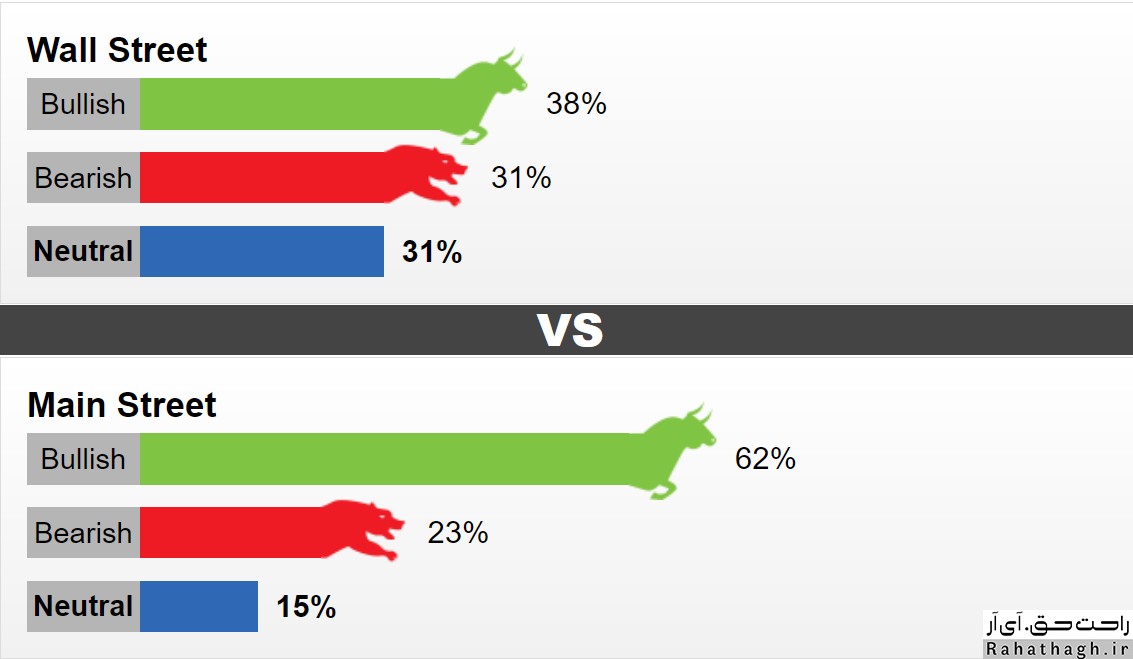

This week, 16 Wall Street activists took part in the weekly evaluation of the Kitco site. 38% predict that the global gold ounce trend will be upward this week. 31% predict that the price of an ounce of global gold will fall. Another 31% expect a trend-free or neutral market. 1611 Main Street investors also took part in an online poll. 62% were in favor of the uptrend, 23% were in favor of the downtrend and 15% were in favor of the market without trend or neutral. Not only are a significant number of small investors optimistic about the medium-term trend in global ounces of gold, but the number of pollsters has reached its highest level in a month.

The views of gold market professionals

Adrian Day, President of Adrian D. Capital Management Company

This professional activist is pessimistic about this week's trend of global gold. He expects prices to fall. However, he predicts that the market is at a price floor and a possible price drop will be the last price drop in the market. "We can expect further price declines from current levels, but prices will continue to rise again (meaning prices will not continue to fall). "But even if the price goes down, I will not be a seller." He went on to say that by injecting high liquidity into the world financial system, being a gold seller is a dangerous job.

Adam Button leads Forexlive.com Currency Strategy Team

This professional activist is also optimistic about the global gold ounce trend. According to him, maintaining support at $ 1680 is a good sign for the upward trend of gold ounces. "The market has learned to cope with high rates of return. "This week's meeting of the US Federal Reserve is also unlikely to change monetary policy."

Colin Cieszynski Senior Market Strategy at SIA Capital Management

The activist believes that the rapid growth of the US economy will make it difficult to raise the price of an ounce of global gold. "I doubt the Federal Reserve will downplay the rapid rise in inflation or try to stop the dollar from appreciating and the rate of return," he said. "I do not think the Federal Reserve, like the European Central Bank, is ready to intervene in the market."