تحلیل هفتگی سایت کیتکو (Kitco) درباره طلای جهانی: بازار هنوز هم به روند صعودی خود خوشبین است.

بر اساس تحلیل هفتگی سایت کیتکو (Kitco News)، فعالین حرفهای بازار و سرمایه گذاران خرد توقع دارند که قیمت طلای جهانی در معاملات هفته پیش رو افزایش داشته باشد، این نظر در حالی است که مقاومت قوی در میانگین متحرک ۵۰ روز وجود دارد.

ارزیابی هفتگی سایت کیتکو حاکی از آن است که خوشبینیها به افزایش قیمت طلا همچنان بالاست، به خصوص که قیمت طلای جهانی توانسته در نیمه معاملات هفته گذشته به بالاترین سطح قیمتی در یک ماه گذشته خود برسد. بسیاری از تحلیلگران معتقدند که افزایش فشارهای تورمی باعث افزایش قیمت خواهد شد. همچنین فدرال رزرو هم معتقد است که رشد سریع تورم موقتی بوده و نیازی به افزایش نرخ بهره یا کاهش حجم خرید اوراق قرضه نیست. باید توجه داشت که تغییر سیاستهای پولی فدرال رزرو ریسک جدی برای بازار طلا به حساب می آید و فعلاً به نظر میرسد که خبری از تغییر سیاستهای پولی نیست.

همچنین رئیس فدرال رزرو آمریکا در برابر اعضای کنگره گفته است که رشد سریع تورم در چند ماه آینده هم ادامه دارد. از نظر پاول رشد سریع تورم موقتی خواهد بود. پاول معتقد است که اوضاع اقتصادی آمریکا به گونهای تغییر نداشته که شرایط برای خروج از سیاستهای انبساطی پولی فراهم شود. او گفته است که: از نظر ما نرخ بهره فعلی مناسب شرایط اقتصادی آمریکاست. پاول بیان کرد که سیاست های پولی زمانی تغییر خواهند کرد که اقتصاد آمریکا به وضعیت اشتغال کامل برسد.

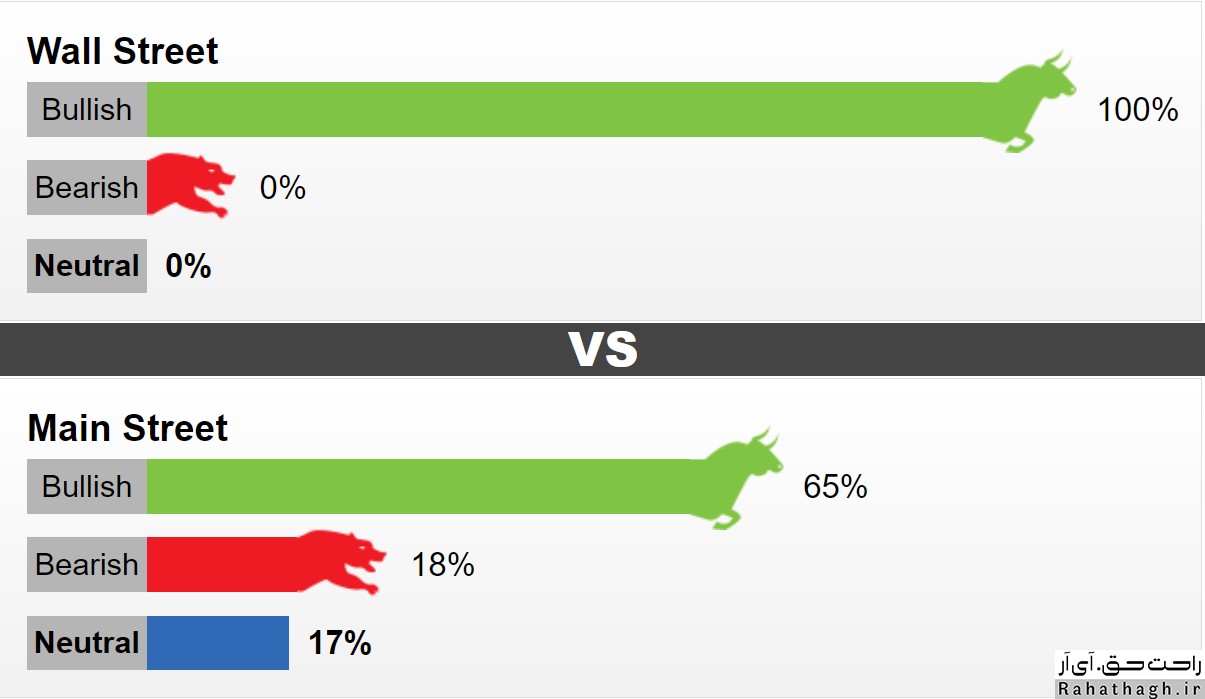

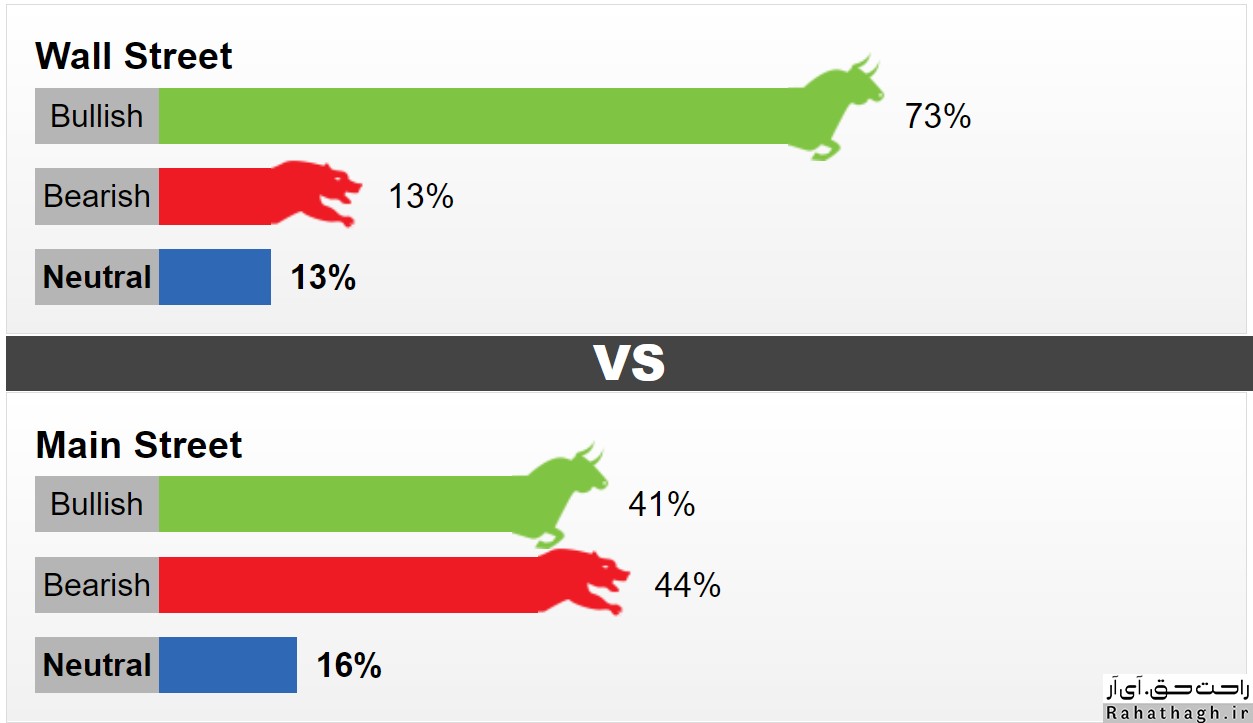

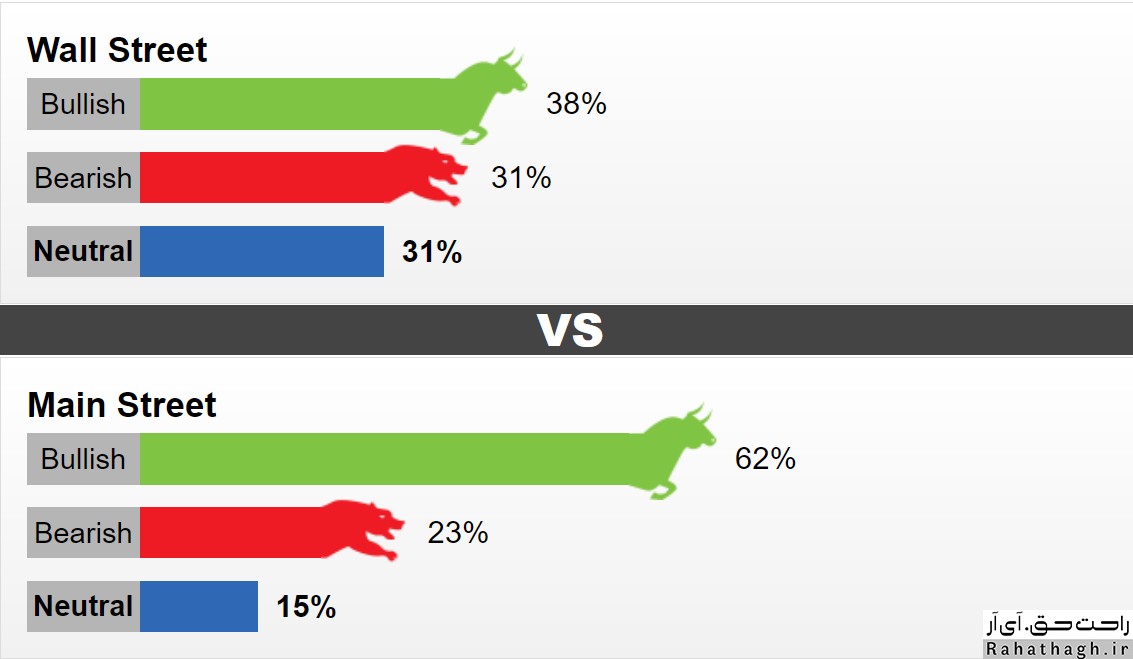

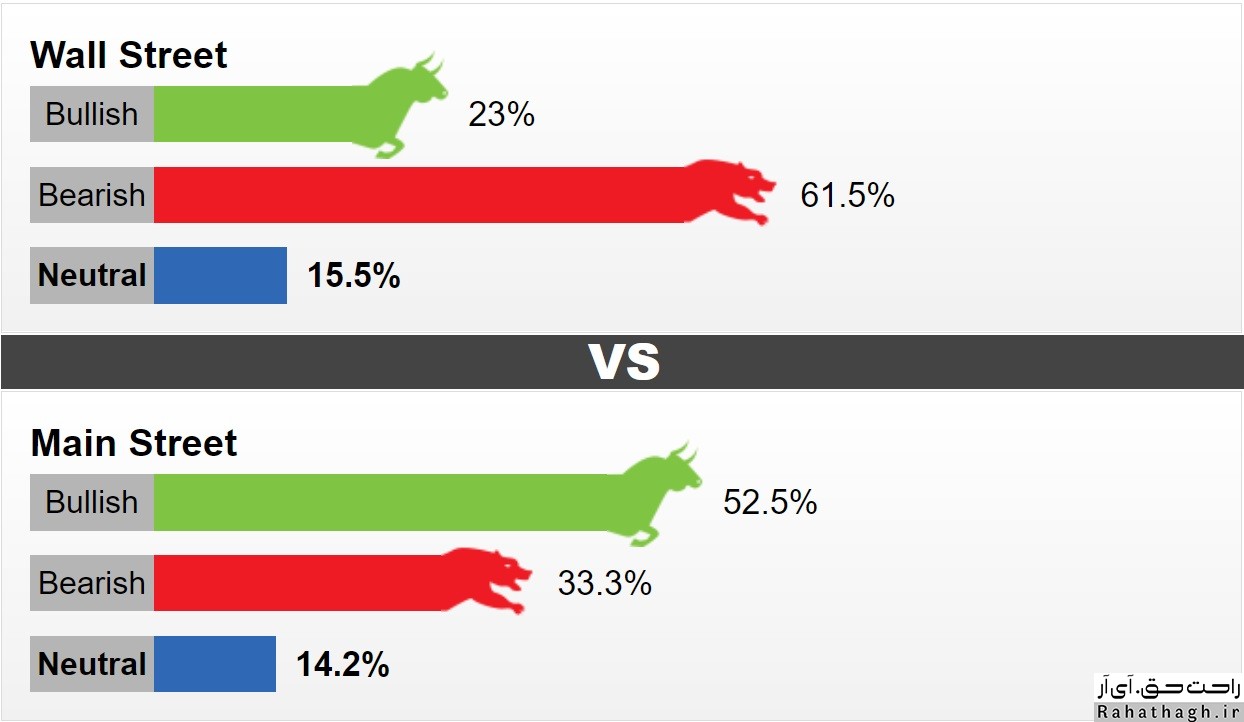

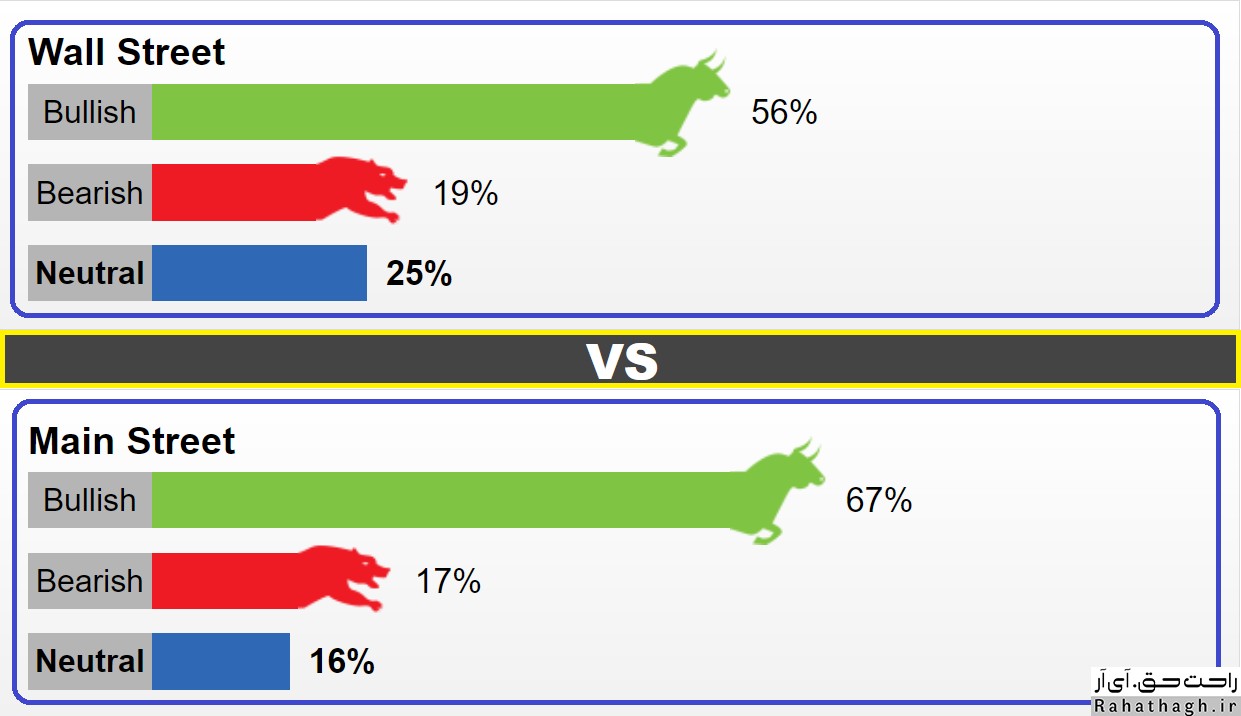

در این هفته ۱۶ فعال حرفهای (Wall Street) در ارزیابی هفتگی کیتکو (Kitco) شرکت داشتند. ۵۶ درصد پیشبینی کردند که در این هفته طلای جهانی می تواند روند صعودی داشته باشد. ۱۹ درصد دیگر انتظار داشتند که روند بازار نزولی باشد. ۲۵ درصد هم بازار را بدون روند یا خنثی براورد کردند. در همین حال ۸۳۶ سرمایهگذار خرد (Main Street) نیز در نظرسنجی آنلاین شرکت کردهاند. ۶۷ درصد طرفدار روند صعودی، ۱۷ درصد طرفدار روند نزولی و ۱۶ درصد هم طرفدار روند خنثی هستند.

نظر فعالین حرفه ای بازار در مورد بازار این هفته طلای جهانی

آدام باتن (Adam Button) استراتژیست ارشد بازار در Forexlive.com

باتن معتقد است که با وجود اختلافنظرها بر سر تورم آمریکا، ریسکهای اقتصادی همچنان از قیمتهای بالاتر طلا حمایت خواهند کرد. چشمانداز بنیادی طلا همچنان مبهم است. سیگنالیهایی که از فدرال رزرو، تورم و کرونای دلتا صادر میشود گیج کننده هستند. اما در کل همه چیز از پایین باقی ماندن نرخ بهره حکایت دارد. در بازار طلا، من فکر میکنم که این خبر خوبی است و باعث خواهد شد تا قیمت طلا به محدوده ۱۹۰۰ یا نزدیکی آن صعود کند.

دارین نیوسام (Darin Newsom) تحلیلگر مستقل بازار

این فعال حرفهای بر خلاف سایرین به آینده بازار طلا بدبین است. او گفته که واکنش منفی طلا به مقاومتهای کلیدی میتواند فشارهای فروش را در هفته پیش رو تشدید کند. از نظر او سطح کلیدی بازار در ۱۷۵۲ دلار قرار گرفته است. اگر طلا از این حمایت عبور کند، تا کفهای قیمتی ماه مارس در زیر ۱۷۰۰ دلار پایین خواهد آمد.

آدام باتن (Adam Button) استراتژیست ارشد بازار در Forexlive.com

باتن معتقد است که با وجود اختلافنظرها بر سر تورم آمریکا، ریسکهای اقتصادی همچنان از قیمتهای بالاتر طلا حمایت خواهند کرد. چشمانداز بنیادی طلا همچنان مبهم است. سیگنالیهایی که از فدرال رزرو، تورم و کرونای دلتا صادر میشود گیج کننده هستند. اما در کل همه چیز از پایین باقی ماندن نرخ بهره حکایت دارد. در بازار طلا، من فکر میکنم که این خبر خوبی است و باعث خواهد شد تا قیمت طلا به محدوده ۱۹۰۰ یا نزدیکی آن صعود کند.

آدریان دی (Adrian Day) رئیس شرکت مدیریت دارایی

آدریان دی طرفدار روند صعودی است. از نظر او همزمان با بیاعتباری بانکهای مرکزی در بازارهای مالی، طلا برای سرمایهگذاران جذابیت پیدا کرده است. سرمایهگذاران زیادی به فدرال رزرو و سایر بانکهای مرکزی دنیا بیاعتماد شدهاند. در واقع برخلاف فدرال رزرو، سرمایهگذاران به این نتیجه رسیدهاند که رشد تورم قوی و ادامهدار خواهد بود.

میشل مور (Michael Moor) مؤسس Moor Analytics

این فعال حرفهای هم نسبت به روند میانمدت بازار طلا بدبین است و منتظر واکنش بازار به محدوده ۱۷۵۰ دلاری است.

مارک چندلر (Marc Chandler) مدیر شرکت Bannockburn Global Forex

هر چند که مارک چندلر فکر میکند که قیمت اونس طلای جهانی افزایش یافته و تشکیل اوج داده، اما از نظر او طلا این قدرت را دارد که تا مقاومت ۱۸۵۰ دلاری بالا بیاید.

کوین گردی (Kevin Grady) رئیس شرکت Phoenix Futures and Options LLC

این فعال حرفهای گفته که بعد از صعود قیمت اونس طلای جهانی به اوج یک ماهه، بازار با مقاومتهای تکنیکالی مواجه شده و نتوانسته از میانگین متحرک ۵۰ روز در ۱۸۳۷ دلار عبور کند. از نظر او، روند طلا خنثی است. با این حال طلا توانسته موقعیت خود را به خوبی در بالای میانگین متحرک ۲۰۰ روز حفظ کند.

بسیاری از سرمایهگذاران در تلاش هستند تا قیمت منصفانه اونس طلای جهانی را پیدا کنند. به نظر میرسد که از نظر بازار قیمت منصفانه فعلی بازار در اطراف ۱۸۰۰ دلار قرار گرفته است. گردی در ادامه گفته که به معامله فروش در بازار طلا فکر نمیکند، چونکه وضعیت بنیادی طلا قوی است. واقعیت این است که رشد تورم سریع بوده، سیاستهای انبساطی در حال اجراست و ارزهای اصلی هم در حال تضعیف هستند، به همین دلیل قیمت طلا باید بیشتر از این بالا بیاید.

According to

According to