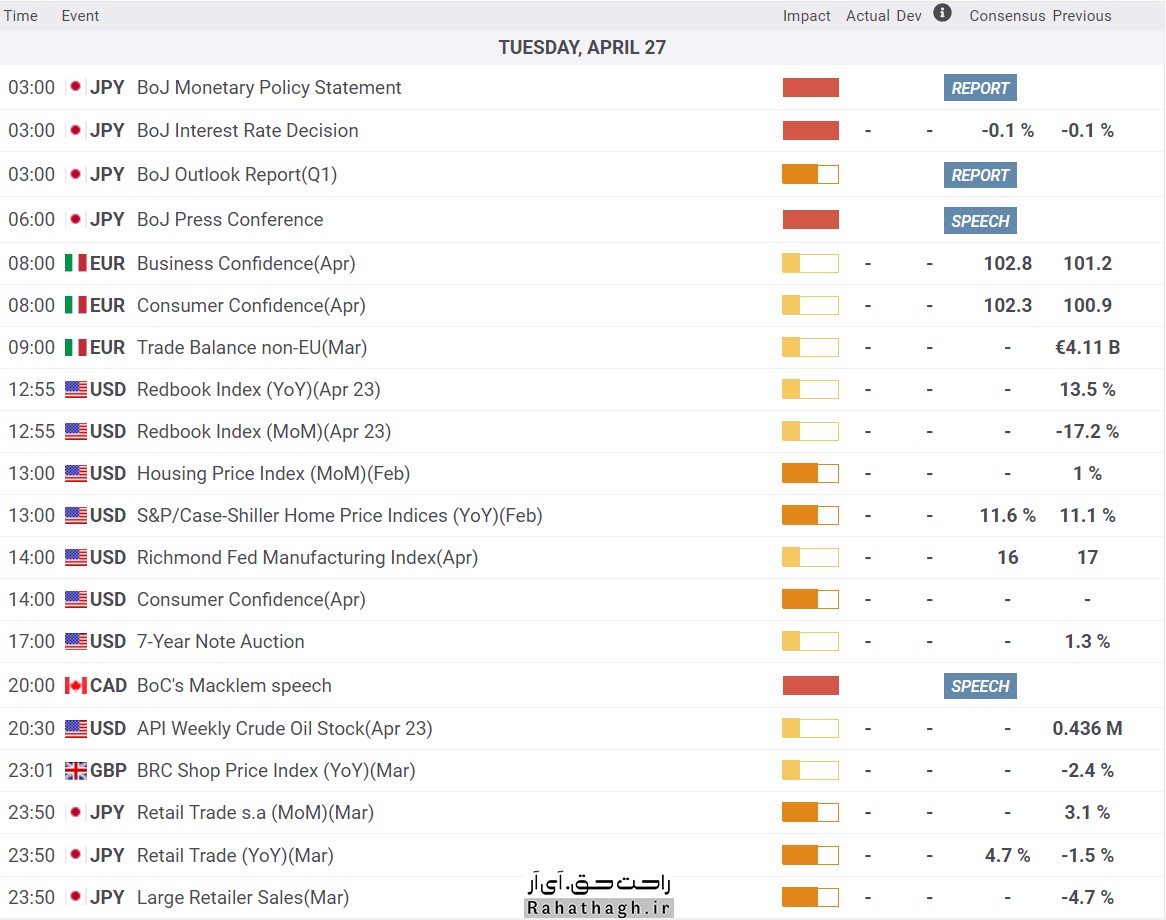

Economic calendar Tuesday, April 27

Fundamental analysis of the US dollar Sunday, April 18

US 10-year Treasury bond yields have fallen to 1.53 percent

The US dollar index is still below the 200-day moving average at 92.21. US 10-year Treasury yields failed to rise, falling to 1.53 percent (new monthly floor). Optimism about the future of the global economy, or risky currents, has also reduced demand for safe-haven assets such as the US dollar.

The US dollar index has been declining since the beginning of April. The dollar has fallen, despite a 9.8 percent rise in the US retail index. This means that economic data may no longer be relevant to the US dollar. Because the US Federal Reserve has decided not to change its monetary policy for the next few years. Recently, the Vice President of the US Federal Reserve stressed that even a sharp fall in the unemployment rate is not an excuse to raise interest rates. This means that we should expect a further reduction in the rate of return on Treasury bonds and a weakening of the US dollar.

The initial reaction of the dollar, the Treasury and the US stock market to the approval of the financial package

Investors are keen to buy and hold US dollars. In global markets and this month, the US dollar index has climbed to its highest level in four months. The US Senate has approved Biden's $ 1.9 trillion bailout package, and the House of Representatives is expected to approve it today and sign it by the end of the week.

Under a previous US government support program, $ 600 in subsidies were able to support US retail and consumer spending. This time, a $ 1,400 support payment is planned and is expected to support the US economy more than ever. According to the US government, approximately 98% of those who received the $ 600 payment will also receive the $ 1,400 government payment. In the meantime, the benefits for the unemployed have been extended. US government support, along with widespread vaccination in the United States, will support the US economic recovery.

Yesterday, the US stock market showed a vague performance in response to the approval of the government financial package. While the Dow Jones industrial average rose, the S&P 500 and NASDAQ stock indexes fell. It seems that in the current situation, investors are not interested in buying shares of technology companies. The US dollar has also reacted positively. US 10-year Treasury yields also rose above 1.60 percent. From a fundamental analysis point of view, the US dollar is expected to continue to grow and the main focus of the market will be on US inflation indicators. US inflation data will be released on Wednesday. Given that energy prices rose sharply in February, US inflation data is expected to be stronger than market forecasts.

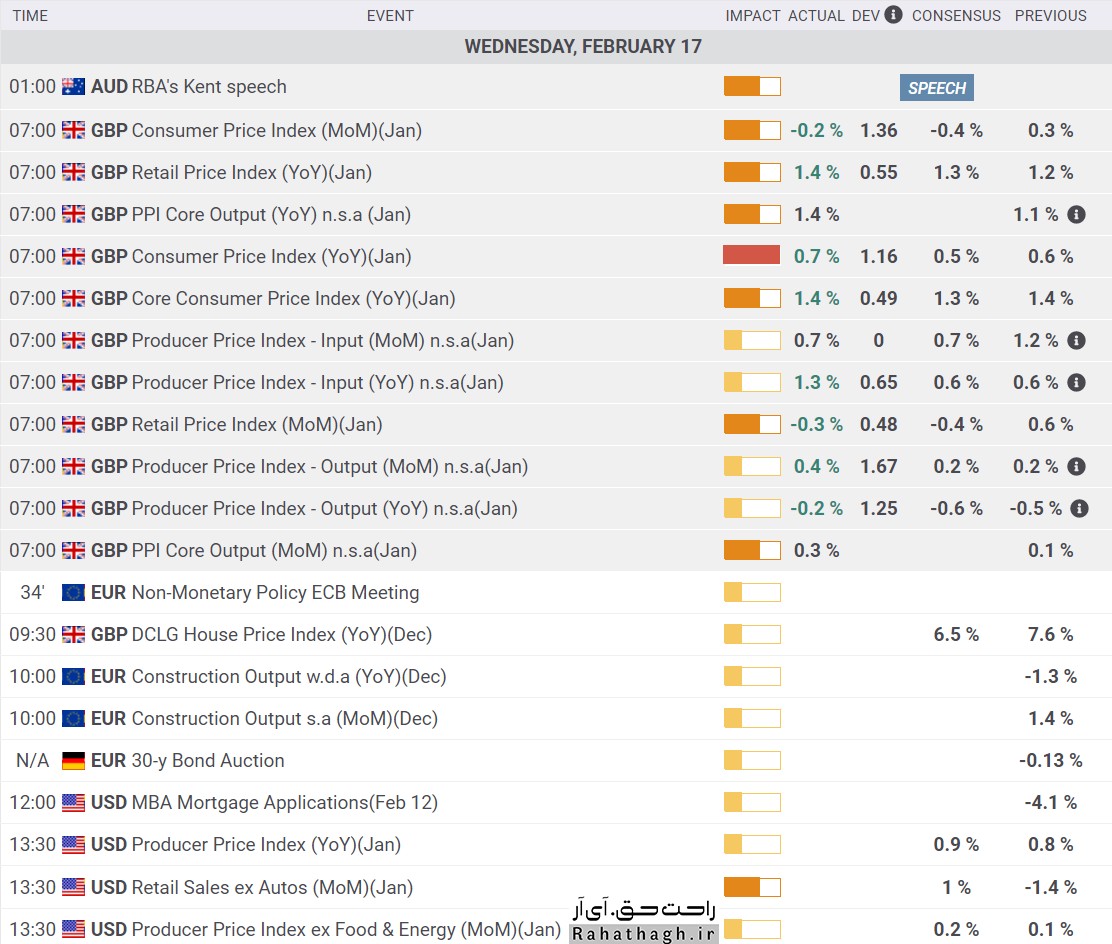

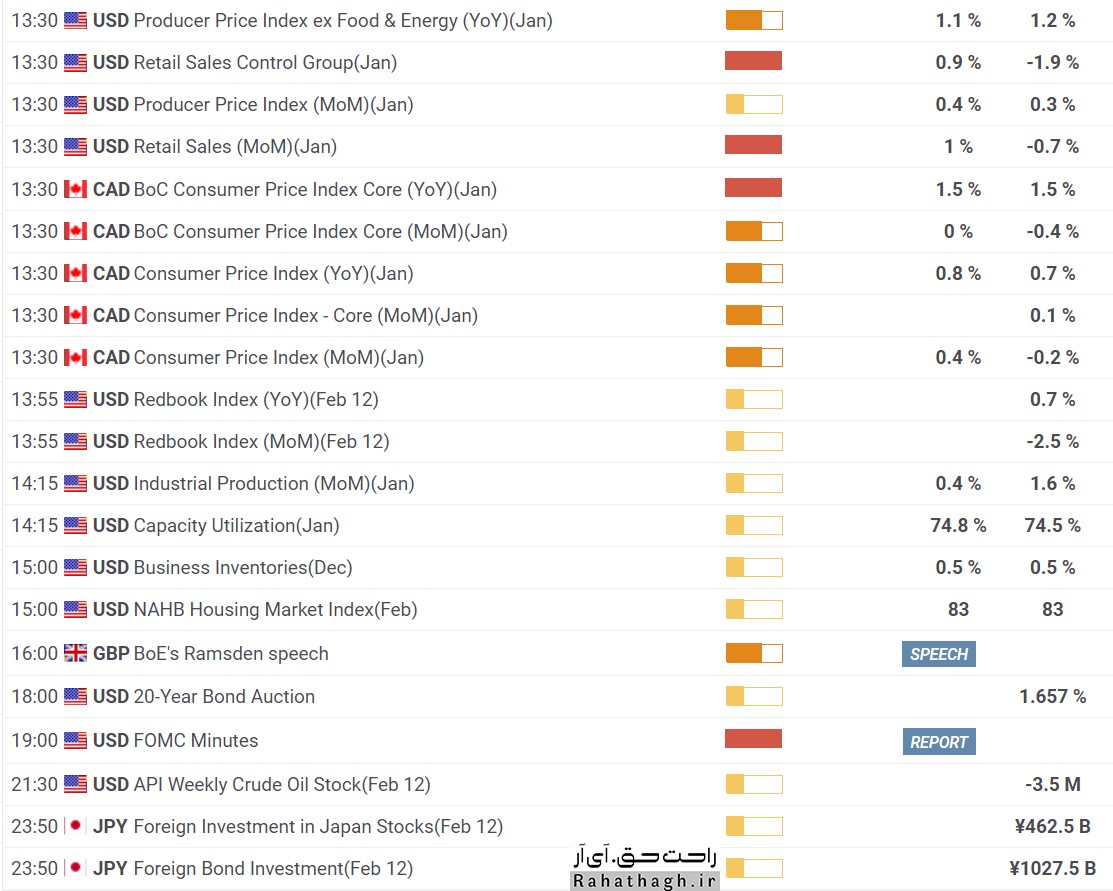

Economic calendar Wednesday, February 17

تقویم اقتصادی فارکس امروز

تقویم اقتصادی فارکس امروز