Weekly evaluation of Kitco site of gold market Sunday, April 25

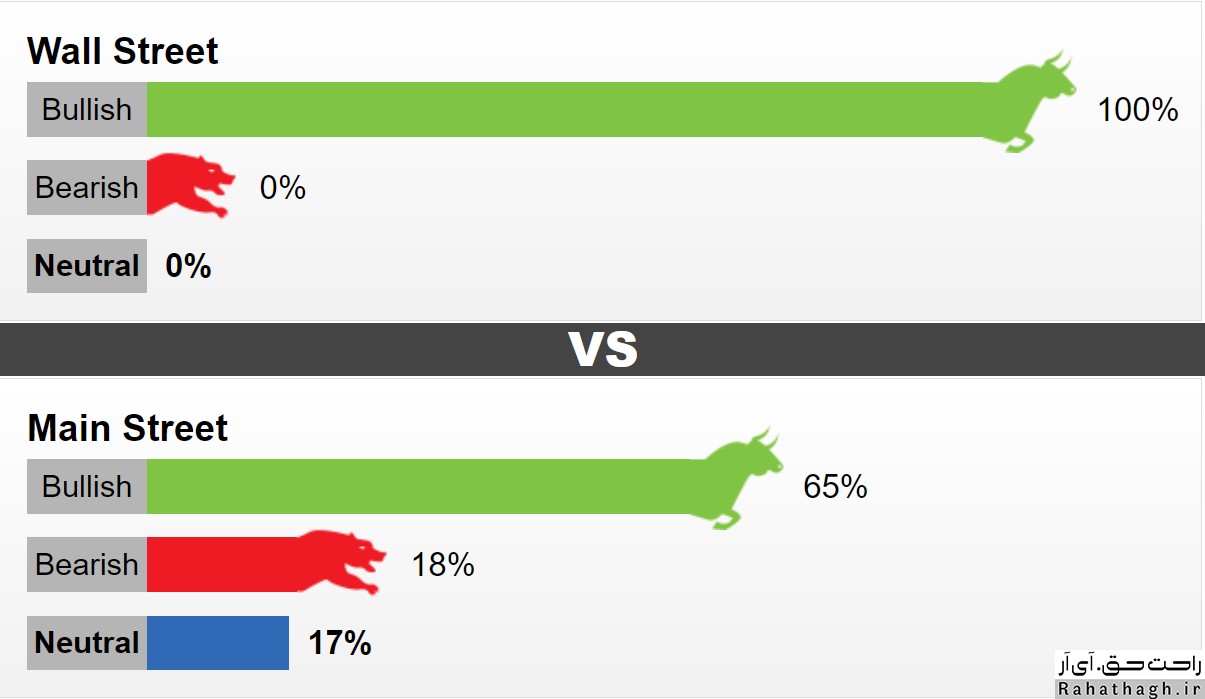

An ounce of global gold has failed to break above the $ 1,800 resistance, making buyers pessimistic about the future. Kitco News' weekly assessment shows that the expectations and forecasts of market professionals have changed. Last week, all market traders expected an increase in the price of an ounce of global gold, but since the market could not cross $ 1,800, everyone expects the market to fluctuate in the neutral phase for some time.

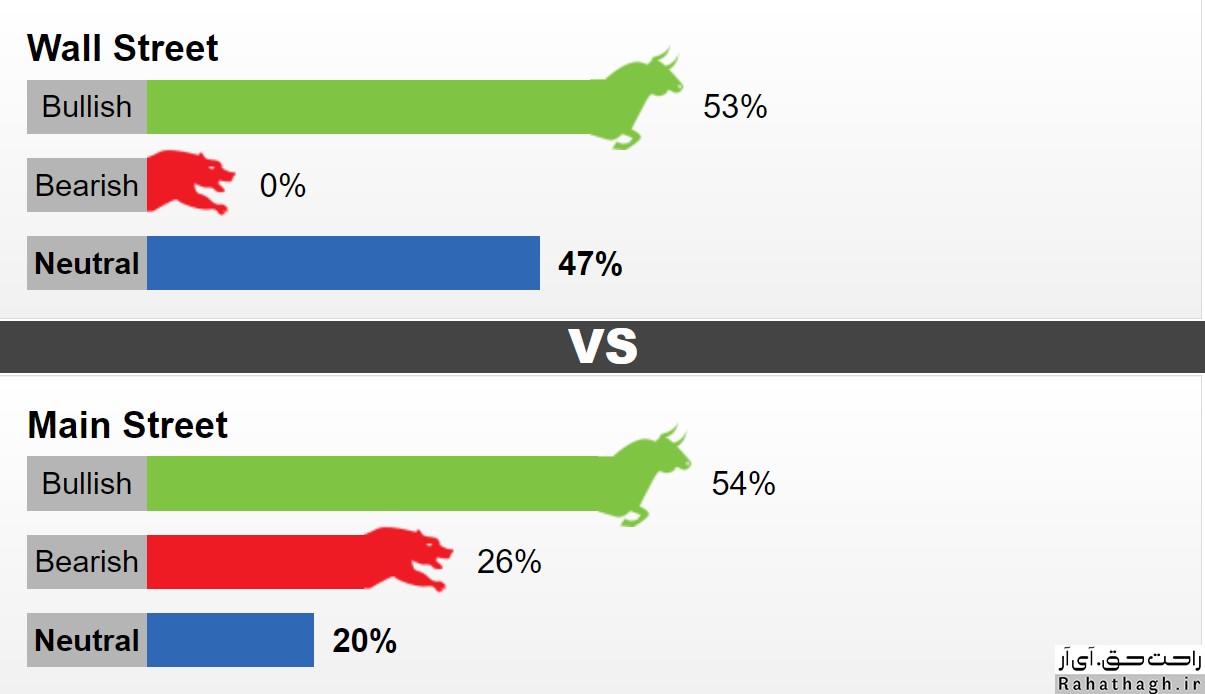

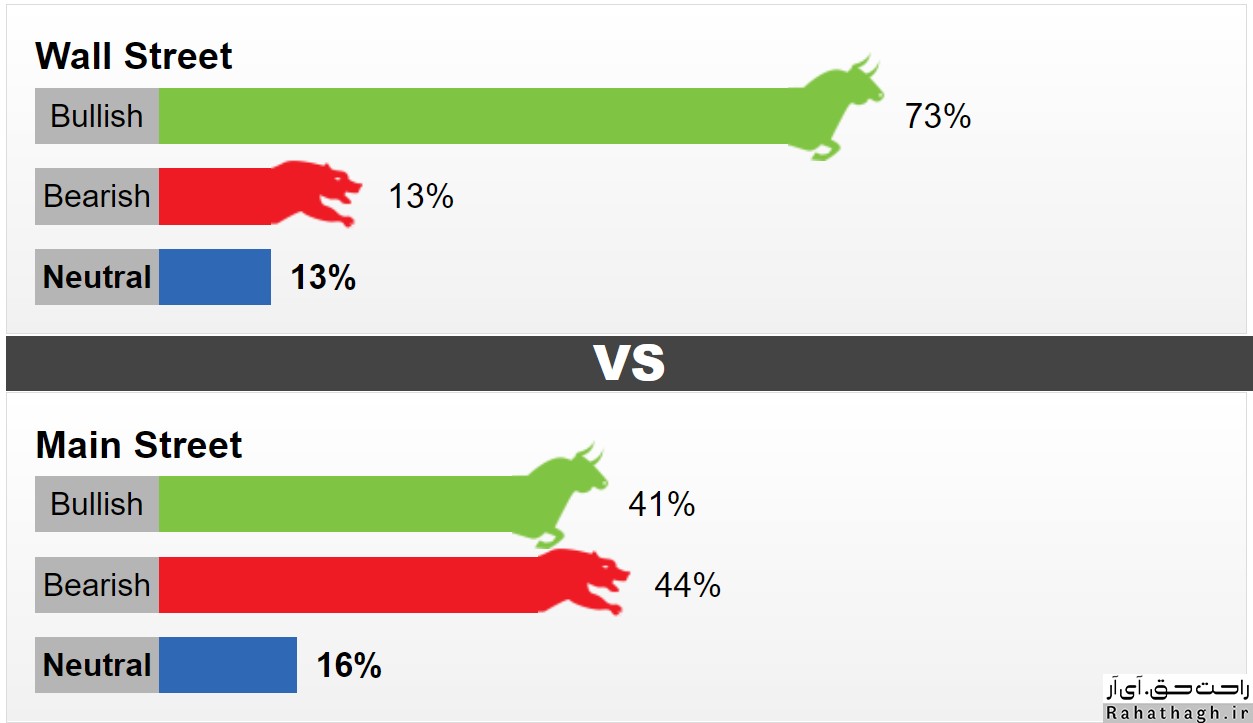

This week, 17 Wall Street activists took part in an online evaluation of the Kitco site. 41% predict that the global gold ounce trend will be neutral. Another 41% expect a trend-free market. Meanwhile, 18% of analysts predict that the global gold ounce market trend will decline. Meanwhile, 850 Main Street investors took part in the online poll. 68% were in favor of an uptrend, 28% were in favor of a downtrend and 14% were in favor of a trend-neutral market.

Last week, XAUUSD tried to reach close to $ 1,800, but good US economic data did not allow gold to grow. The US New Homes sales index rose the most in March from 2006. US PMIs also showed strong optimism in the US manufacturing and services sectors.

Analysis of market professionals

Adam Button Senior Market Strategist at Forexlive.com

"The price of an ounce of global gold has risen to around $ 1,675 after forming a twin floor and is entering a neutral phase below $ 1,800 and is resting."

Kevin Grady, President of Phoenix Futures and Options LLC

"Despite the strong recovery in the US economy, selling ounces of global gold is hard work. But as economic recovery accelerates, so will inflationary pressures. "In that case, the ounce of global gold will strengthen as inflationary pressures intensify." In terms of roundness, the medium-term trend of global gold is neutral or trendless.

Jim Wyckoff Technical Analyst at Kitko

According to Vaikov, the global ounce gold trend is still bullish. "The trend of daily charts of global gold and silver is bullish."

Adrian Day, President of Adrian D. Capital Management Company

Although the price of an ounce of global gold was expected to move in an upward straight line and this did not happen, the medium-term trend of an ounce of gold is still bullish. The price of an ounce of global gold has climbed to the top of the recent neutral range at $ 1,750. "The weakening US dollar, declining rates of return on Treasury bonds and the US government's new financial and support package have all supported the global ounce price."

Marc Chandler is the CEO of Bannockburn Global Forex

The professional activist believes that the most important risky event this week is the US Federal Reserve interest rate meeting. According to him, if the US Federal Reserve continues to be inclined to expansionary monetary policy, the price of an ounce of global gold could exceed $ 1,800.

Darin Newsom Independent Market Analyst

Darin Newsam believes that the price of an ounce of global gold could fall to support around $ 1750. "It seems that after the formation of daily return candelas on Wednesdays and Thursdays, the short-term trend of global gold ounces has changed."