Weekly Gold Analysis Monday, February 7

The ounce of global gold in mid-August 2018, in the form of support hit $ 1160 and started a new bullish rally, so that the price of gold rose to $ 2075 over two years. This is a historic price point for gold. The upward movement of gold stopped after hitting the range of 2050-2075 and then we saw the entry of ounces of gold into the downtrend channel, so that the market moved to the moving average of 50.

The ounce of gold was resisted by $ 1875 and the moving average of 20, which resulted in the market moving to an average of 50. An ounce of gold has returned to the upside after each hit. So in this week's trading, if the 50-day moving average and the $ 1800 trend are turned into support, one can expect the market to return to the 20-day moving average, the $ 1875 level and finally the channel ceiling. The failure of the channel resistance can make the presence of gold buyers in the market more colorful.

But if the ounce of gold breaks the $ 1800 trend and the average of $ 50, the downtrend will pave the way around the $ 1700 trend.

Activists and investors in the global gold ounce market are skeptical about the future of the market, according to a weekly assessment by Kitco News. Although the majority of market traders expect the price of an ounce of global gold to rise in the coming weeks, among small investors, supporters of the uptrend are less than 50%.

Meanwhile, the price of an ounce of silver has returned below $ 27 and all growth since the beginning of last week has disappeared. The price of silver has fallen after reaching the highest price of the last eight years. The fall in the price of silver has negatively affected the views and expectations of retail investors. Analysts believe that small investors' pessimism about the silver market has spread to the global ounce gold market. Micro-investors, most influenced by the social network, expected a rapid return to the silver market, and this frustration may spread to the gold market.

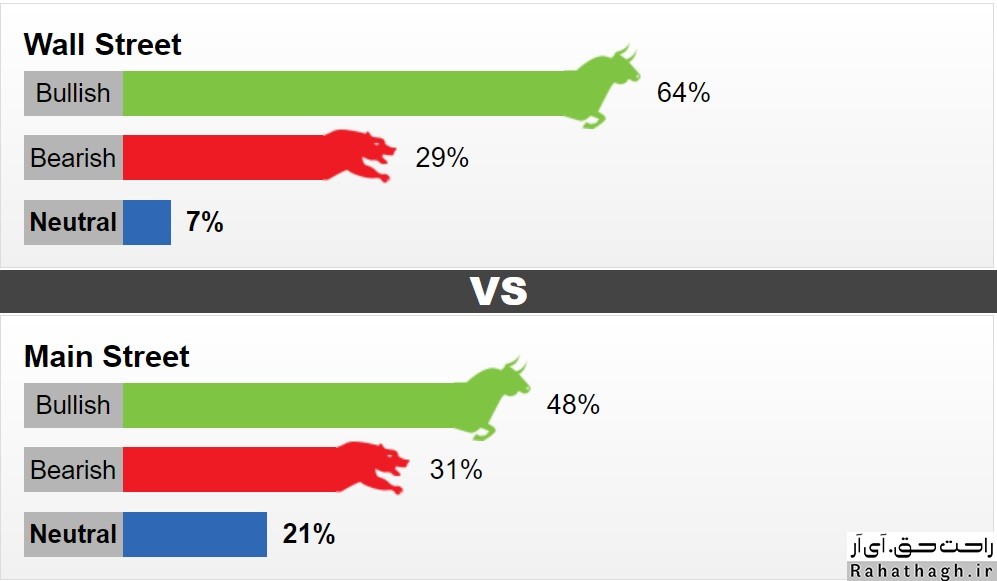

This week, 14 Wall Street activists took part in the weekly evaluation of the Kitco site. 64% predict that this week's trend will be an upward ounce of global gold. Another 29% predict that the market trend will be downtrend and another 7% expect the market to be trending or neutral. A total of 1,823 Main Street activists took part in the online poll. 48% are in favor of the uptrend, 31% are in favor of the downtrend and 21% are in favor of the neutral trend.

Kitco's online poll shows that micro-investor pessimism about the global ounce trend has reached its highest level since late November. At that time, the price of an ounce of world gold had fallen below $ 1,800. Last week, professional activists and small investors expected the price of an ounce of global gold to rise. However, the ounce price of global gold fell by almost 2%.