South Korean money changers reopen cryptocurrency face-to-face shopping centers

Coinone and Bithumb have both reopened their customer centers in the capital in response to growing domestic interest in cryptocurrencies.

Coinone Exchange, one of the top four cryptocurrency exchanges in South Korea, has reopened its offline customer center in Seoul. According to a report in The Korea Herald on April 29, the center initially opened in September 2017, but has since closed due to the company's decision to focus on other business activities.

Currently, with an increase of 20 times more than usual registration of new users of the cryptocurrency exchange in the first quarter of this year, this exchange will resume its offline services for customers. At the end of this month, the Herald reported that Coinone had reached 2 million users.

In addition to reopening an offline hub, Coinone has reportedly doubled its staff to meet information needs and help a wide range of new customers.

The trend seems to be expanding to resume face-to-face customer service in South Korea, with Bithumb, the country's second-largest exchange, opening an offline hub in the capital earlier this week. The Korbit exchange is reportedly considering a similar move.

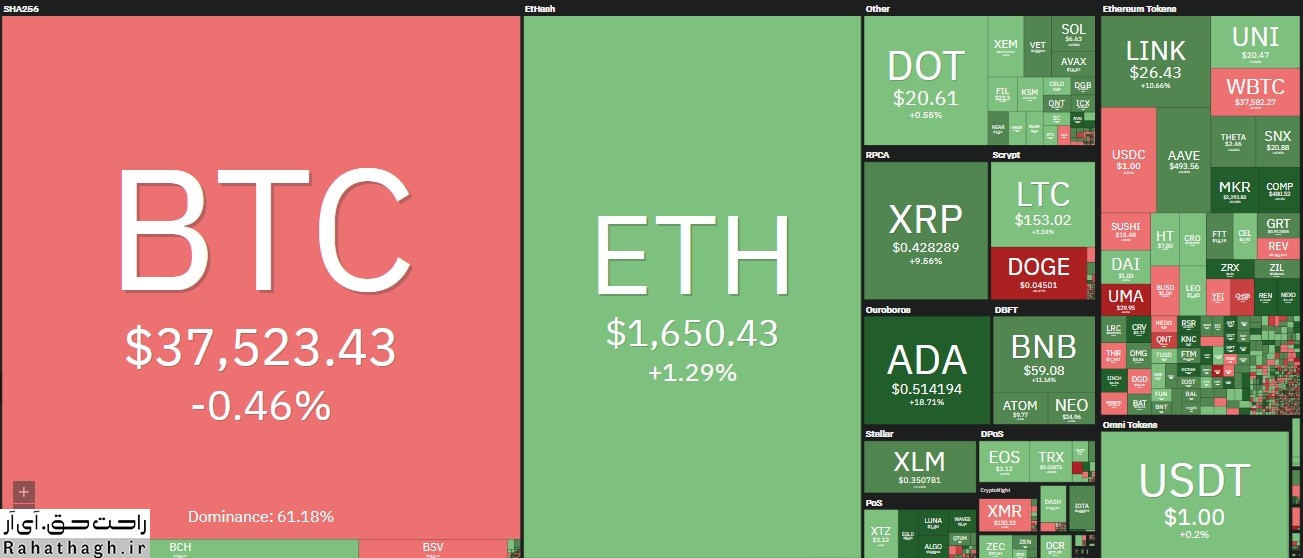

These developments show the rising atmosphere in the South Korean digital currency market, where the price of Bitcoin is recently trading with a new "Kimchi premium" that rises to the highest price of the year. The craze for cryptocurrencies has apparently spread to domestic stock prices as well. Meanwhile, companies holding shares in some of the country's top cryptocurrency operators have seen significant gains in recent weeks.

Analysts predict that the Kakao Forum in South Korea, which owns cash shares in Upbit and Dunamu and is active in the cryptocurrency and blockchain industries, is likely to reap the benefits of Korea's rising cryptocurrency market next year.