Weekly evaluation of Kitco site Monday, April 5

At the same time with the formation of the twin floor below $ 1700, optimism about the future price of an ounce of global gold has been strengthened. Last week, the XAUUSD jumped twice below $ 1,700. Although the optimism of market professionals has been relatively strong, the concerns of small investors have not yet been allayed. The latest weekly assessment of Kitco News shows that disagreements between small investors and market professionals have increased. While gold has been able to jump above the monthly price floor and end the week above $ 1,700, some analysts believe that it is not yet possible to talk about a strong uptrend in the market.

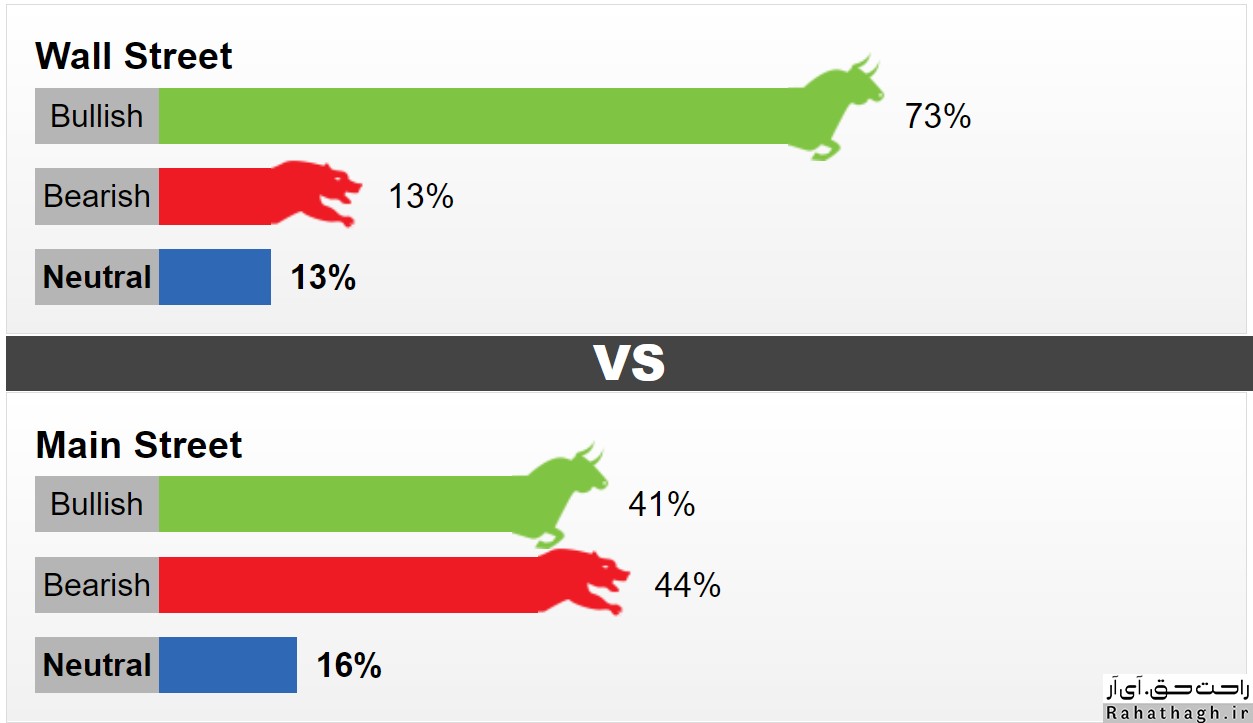

This week, 15 Wall Street activists took part in the weekly evaluation of the Kitco site. 73% predict that this week's trend will be an upward ounce of global gold. 13% forecast a downtrend and another 13% expect a trend-free market. Meanwhile, 1,565 Main Street investors took part in an online poll. 41% are in favor of an uptrend, 44% are in favor of a downtrend and 16% are in favor of a trend-free market.

Analysis of market professionals

Colin Cieszynski SIA Wealth Management Senior Market Strategy

"Last week, the world ounce price of gold experienced a significant drop, so it can be said that the recent price increase is just a technical leap. "I do not expect a steady rising rally in the price of an ounce of global gold, and the market is facing many obstacles." He added that he would only be sure of the market's uptrend if the price of a global ounce of gold went above $ 1,780.

Darin Newsom Independent Market Analyst

The activist expects the market to rise in the short term, but he prefers to rely on the uptrend after the defeat of the $ 1756 resistance. According to Newsom, the global ounce of gold is in fierce competition with the US dollar. The long-term trend of the US dollar seems to be upward. The US dollar and the price of an ounce of world gold are inversely related.

Marc Chandler, senior market strategist at Bannockburn Global Forex

According to Chandler, rising inflation could lead investors to gold. In times of inflation, investors use gold to cover the risk of inflation. "The twin floor will only be confirmed if the price crosses the peak between the two floors, meaning that the global ounce price must rise above $ 1,754 to confirm the twin floor signal."