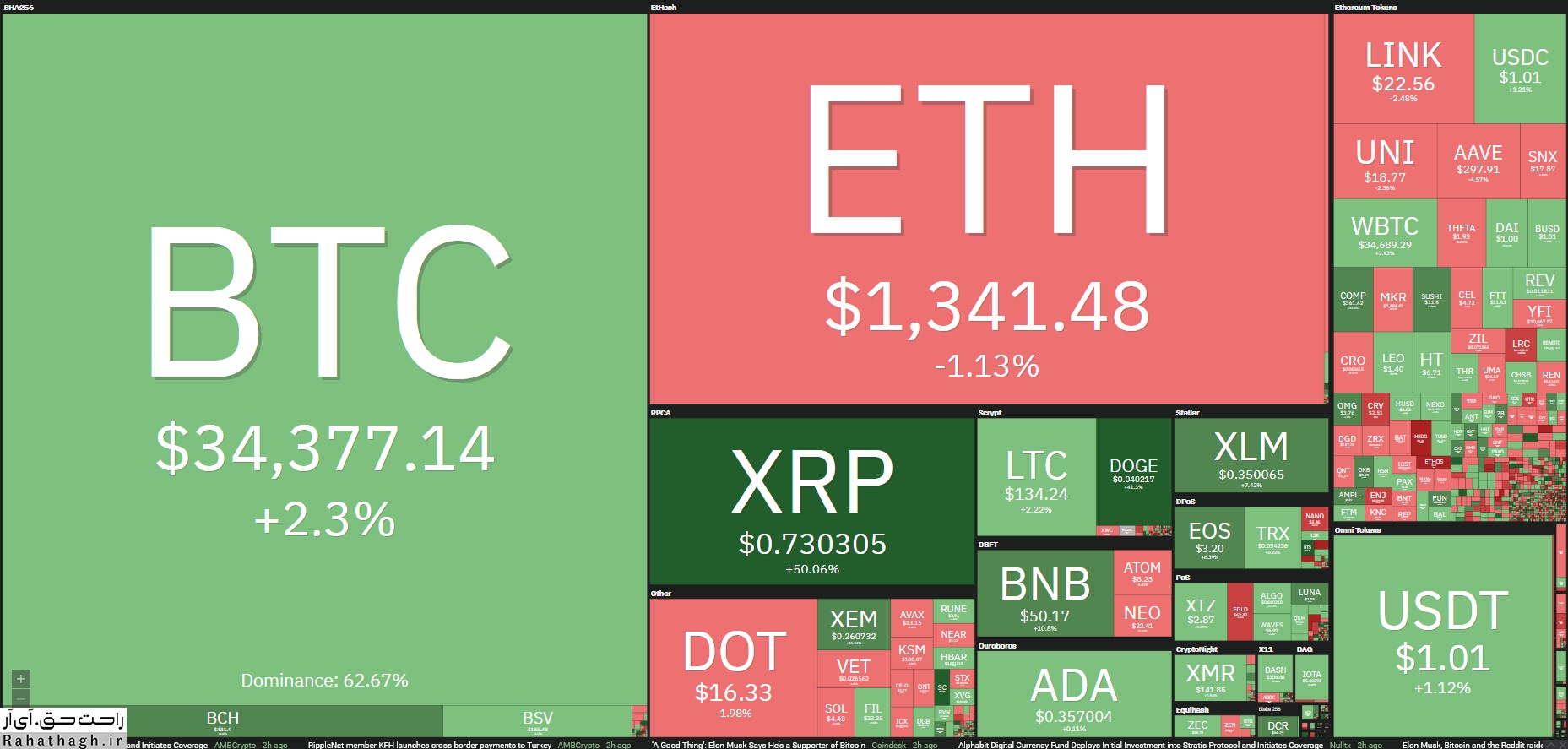

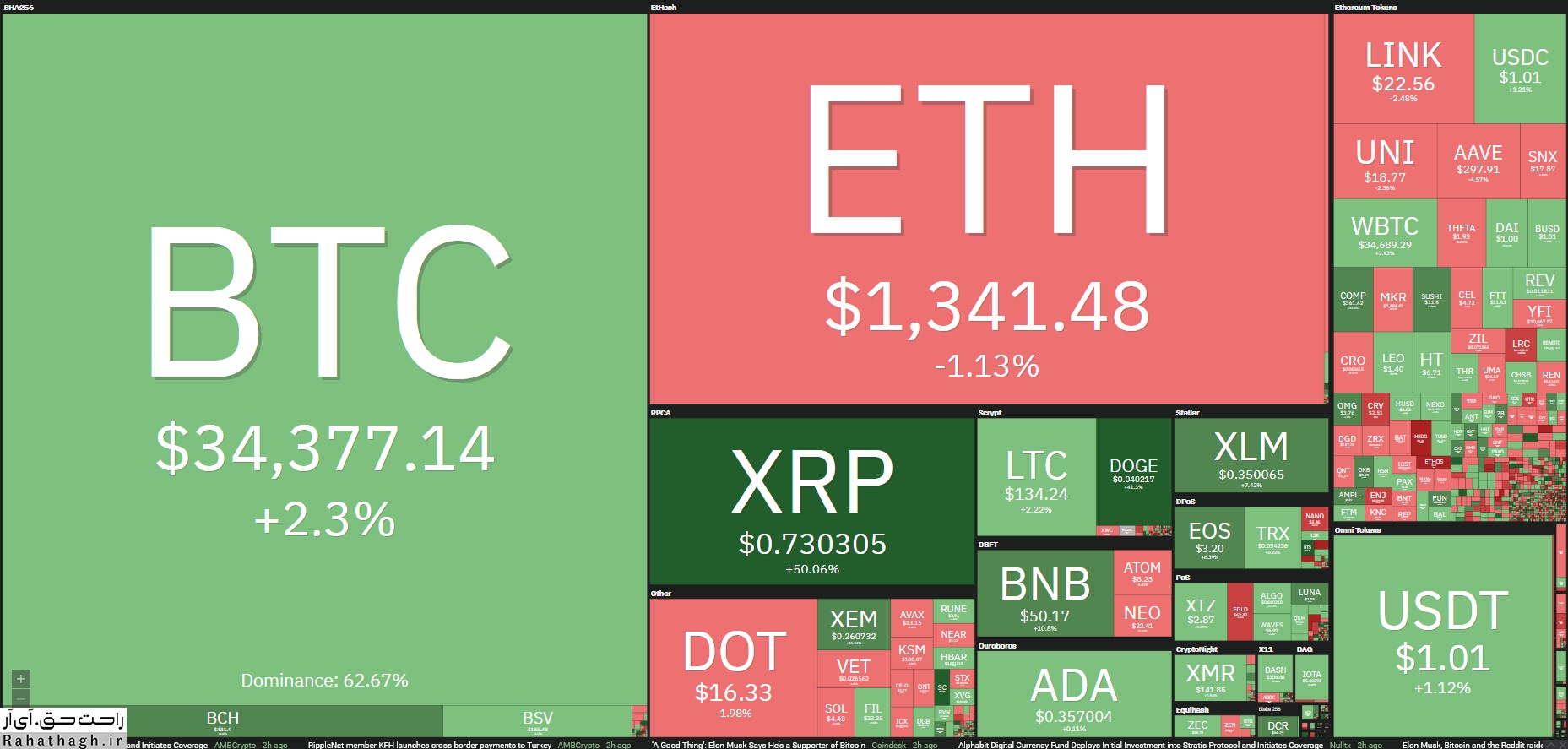

An overview of the cryptocurrency market today

After a sharp drop that caused Bitcoin to hit $ 32,000 again, the asset improved and rose to close to $ 34,000. However, the dominance of bitcoin continues to decline following the dominance of some alternative coins over the currency, including Ripple.

Touch the $ 34,000 level

The market's top cryptocurrency hit a sharp uptrend in bitcoin on Friday after changing the biography of Tesla CEO Ilan Mask's Twitter account.

The asset reacted sharply to the move, adding about $ 7,000 in just a few hours. However, the highly volatile nature of the market has once again manifested itself with the same intensity as the Bitcoin reform.

Although the currency seemed to have calmed down to around $ 34,000, a sudden drop of more than $ 2,000 yesterday pushed it to its daily low of $ 32,000 (on Bitstamp). However, BTC was able to offset the loss to a large extent and is now trading at less than $ 34,000.

From a technical point of view, the first lines of resistance will be $ 34,000, $ 34,450 and $ 35,000 if Bitcoin continues to grow. In contrast, support levels of $ 32,500, $ 32,000 and $ 31,200 will help the currency if prices fall.

Most replacement coins have been relatively stable over the past few days with prices falling or rising slightly. Atrium fell less than 3 percent to $ 1,315. China Link (3.5%), Polkadat (3%) and Cardano (2-%) are examples of the top 10 currencies on the market that are seen in red today.

In contrast, Bitcoin Cash (1.3%), Bainance Coin (3%) and Stellar (3%) have seen some price increases.

However, Ripple still performed best. After several weeks of unfavorable price movements due to allegations made by the US Securities and Exchange Commission, the price of XRP has risen sharply in the past few days.

In the last 24 hours alone, the Ripple native token has grown 50%, reaching $ 0.67, up 160% from Friday. While some believe that the dramatic increase is due to Ripple's response to the SEC, others speculate that a similarly priced pump has occurred with GameStop and Dogecoin.

PancakeSwap (34%), Dogecoin (30%), Flow (30%), Siacoin (18%), The Graph (17%), Compound (15%), Ampleforth (12%) and EOS (10%) Growth has been observed in 24-hour timeframes.

The rise in the price of altcoins led by Ripple has reduced the dominance of bitcoins by 62%. This figure shows a decrease of about 3% since Friday.

Finally, the total market value of cryptocurrencies remains above the $ 1 trillion mark.