Weekly evaluation of Kitco site of gold market ,May 3

Disappointment is back in the global gold ounce market. The XAUUSD price could not cross the $ 1,800 resistance. At the same time, inflationary pressures are intensifying, expansionary monetary policies continue to be strong, and governments are seeking to increase their spending. According to Kitco News, analysts have warned that lower global ounce prices should be prepared for lower prices in such circumstances. However, many analysts believe that the recent price cut is just a pullback to support and will provide a new opportunity to buy.

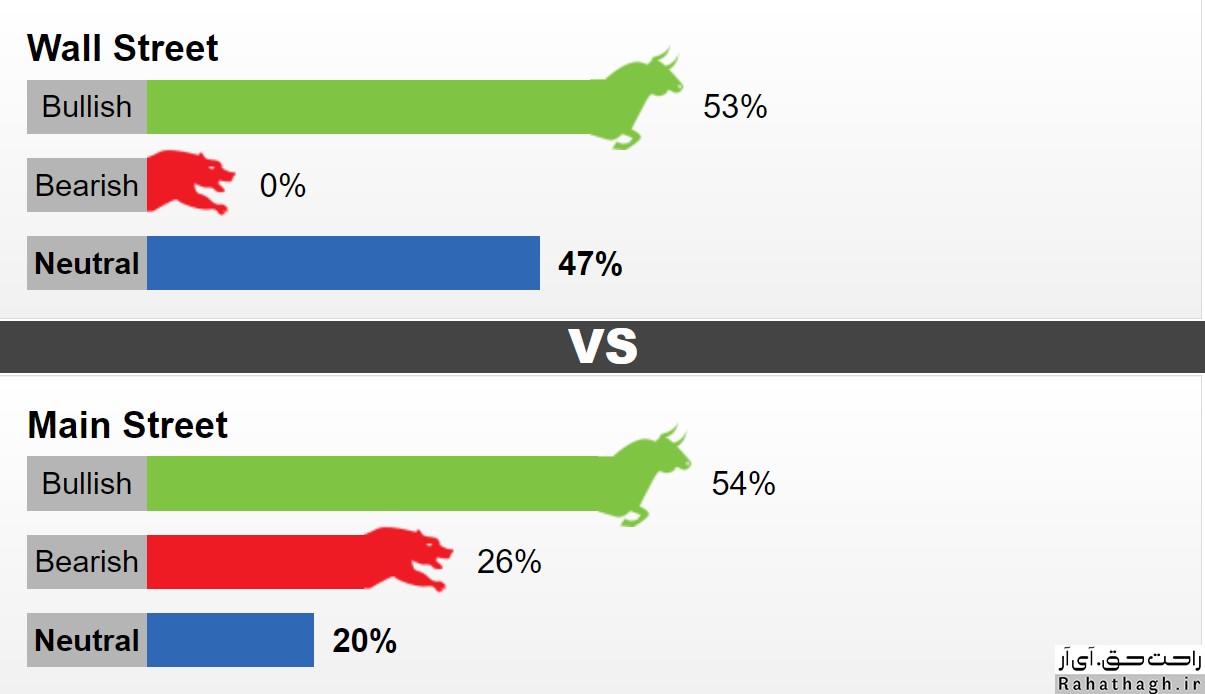

This week, 15 Wall Street activists took part in a weekly evaluation of the Kitco site. Fifty-three percent predict that the global ounce gold trend will be bullish in next week's trading. Another 47% predict that the market will be trendless or neutral. None of the market professionals expect a downward trend in the short term. Meanwhile, 954 Main Street investors took part in the online survey. 54% are in favor of an uptrend, 26% are in favor of a downtrend and 20% are in favor of a trend-neutral market.

Some analysts believe that gold failed to break $ 1800, but at the same time managed to defend the support of $ 1750. For this reason, market participants see last week's price drop as an opportunity to buy gold at lower prices.

Opinions of traders and investors about ounces of global gold

Ole Hansen is a commodity market strategist at Saxo Bank

"Gold has again disappointed its investors."

Adrian Day, President of Adrian D. Capital Management Company

"The price of an ounce of global gold should pull back to $ 1745. Gold broke the $ 1745 resistance in early April. This resistance prevented further growth of gold prices for two months. It is better that the market responds to this resistance as soon as possible in the form of support. The long-term trend of global gold ounces is bullish. "Inflationary pressures have intensified, and the Federal Reserve does not want to counteract the rise in inflation by raising interest rates or exiting the bond-buying program."

Marc Chandler is the CEO of Bannockburn Global Forex

The professional activist believes that if the market does not defend the support of $ 1750, the price of a global ounce of gold could fall to $ 1724. "Technically, the short-term trend of the global ounce of gold tends to decline. "Gold is approaching the $ 1,752 support area, which includes a 38.2% correction in the April Fibonacci rally." Although the long-term ounce of global gold is bullish for the professional activist, gold has performed poorly compared to copper, the stock market and even bitcoin. "There are strong risk aversions in the parallel gold markets and no one likes to wait for gold to grow in this situation. "Investors have better options to buy."