Kitco's weekly estimate of the gold market Sunday, May 16

According to Kitco News's weekly assessment, rising inflationary pressures and worries about the uncertain future of the global economy have once again supported the ounce of global gold. Gold market fluctuations increased last week. Market participants believe that the price of an ounce of global gold could exceed $ 1850. Such a move could be significant in terms of technical analysis. Especially since the $ 1850 resistance range indicates the key correction level and the 200-day moving average.

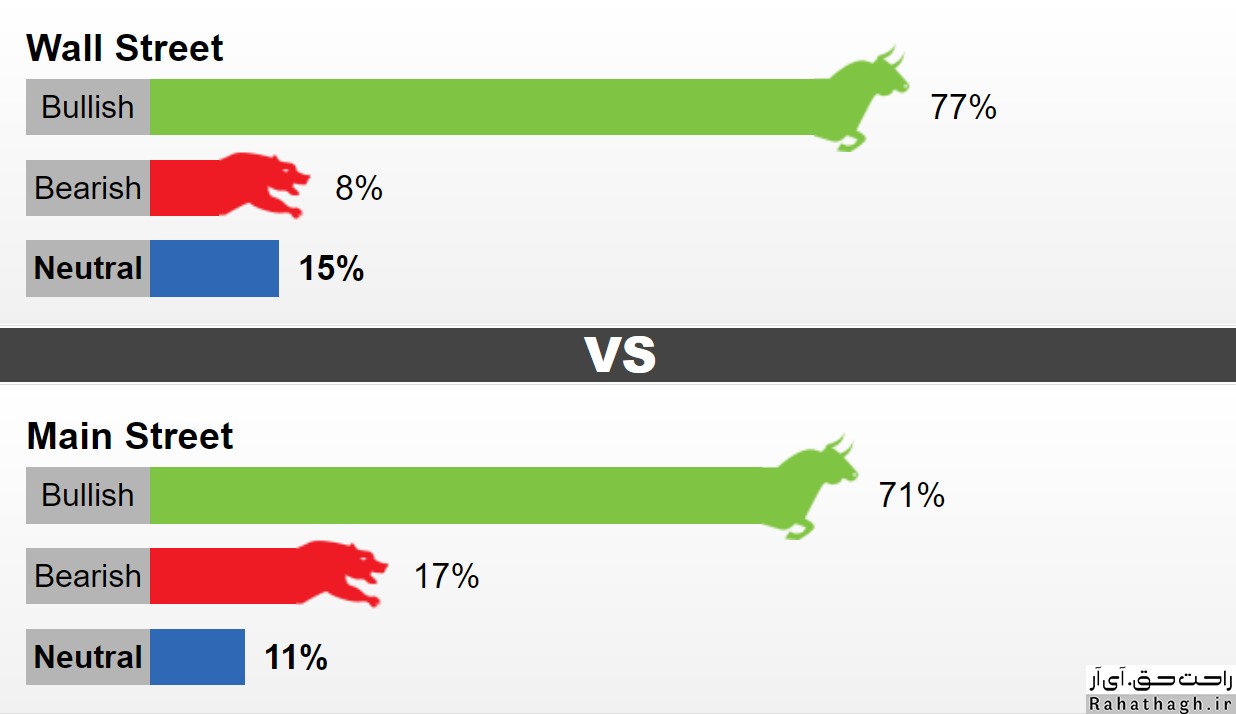

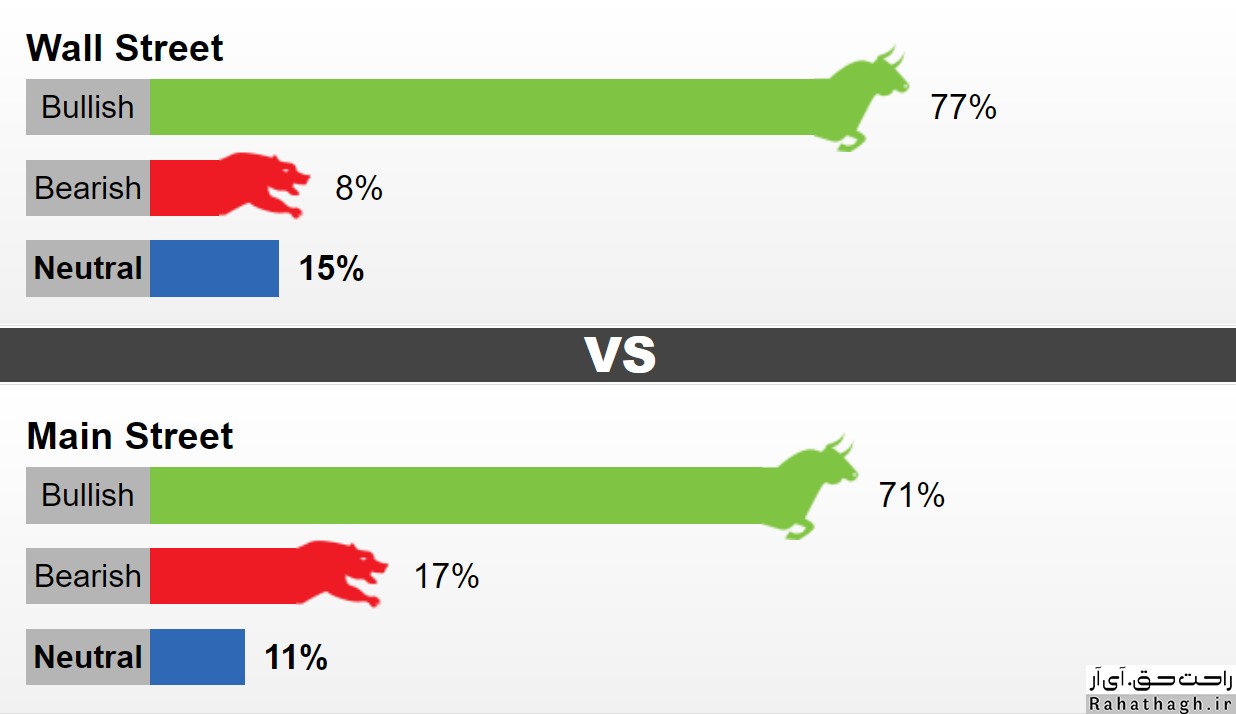

This week, 13 Wall Street activists took part in the weekly evaluation of the Kitco site. 77% predict that the ounce trend of global gold in the next week's trading will be upward. 8% predict that it will be a downward trend. Another 15% expect a trend-free or neutral market. Meanwhile, 464 Main Street investors took part in the online poll. 71% are in favor of an uptrend, 17% are in favor of a downtrend and 11% are in favor of a neutral or no trend market. This week, due to technical problems, the number of participants in the online poll was lower than in previous periods.

Expert opinion of market professionals

Robin Bhar Independent Market Analyst

"The big question on everyone's mind is whether the Fed will get out of expansionary monetary policy sooner than previously predicted due to the rapid rise in inflation," he said. Although inflation has picked up, I think the Federal Reserve can handle the situation. The longer monetary expansionary policies take, the better for gold. "As inflation curves eased, inflation could be justified, but the growth of US economic data has been unbalanced (which is why the Federal Reserve may not be paying attention to rapid inflation at this time)."

Sean Lusk is the CEO of Walsh Trading

Lusk is optimistic about the global ounce uptrend, but not because of rapid inflation, but because of escalating tensions in the Middle East. "I think the global ounce price of gold could be a destination for risk aversion," he said. "It is likely that the price of XAUUSD could cross the key level of $ 1850." He added that the ultimate target of gold is around $ 1900 and after entering the neutral phase, the upward and long-term trend of the market will be revived.

Adrian Day, President of Adrian Investment Management Company

Adrian Dee believes that as inflationary pressures intensify, investors will flock to gold to cover the risk of inflation. "The gold market has changed and investors who left the market in the second half of 2020 are entering the market again. "The Fed may reiterate that rapid inflation is temporary, but in the gold market, rapid inflation is not temporary."

Darin Newsom Independent Market Analyst

Newsam is optimistic about the medium-term ounce of global gold. According to him, the dollar will weaken further. However, he believes that the resistance of $ 1843 is a serious obstacle for the market.

Adam Button is a professional market activist

The professional believes that after a bullish break of $ 1,800, the market will enter a neutral phase for a while. "The price of an ounce of world gold has jumped well from the March price floor and now is the time for the market to rest."

Marc Chandler is the CEO of Bannockburn Global Forex

The professional activist said that although the price of an ounce of global gold has experienced good growth, caution should still be exercised. In his view, the recent rise in gold prices is a bit rapid and the market needs to improve. "It seems that the price of an ounce of global gold wants to hit the 1845-1845 resistance zone, which is the moving average of 200 days. Technical indicators have entered the saturation level. "I think a better market is better for selling than buying, but this week I will focus on treasury rate fluctuations to find new clues."

After forming a

After forming a