Weekly evaluation of Kitco site about GOLD Sunday, June 27

Is GOLD ready to climb?

According to the weekly assessment of the Kitco News site, small investors and professional market participants expect an increase in the price of an ounce of global gold in next week's trading. In last week's trading, the gold market was able to provide support below $ 1,800 and eventually ended with a one percent increase. Two weeks ago, the gold market fell $ 100 in response to a US Federal Reserve rate hike. Gold market analysts are still focusing on dollar fluctuations, treasury yields and macroeconomic data.

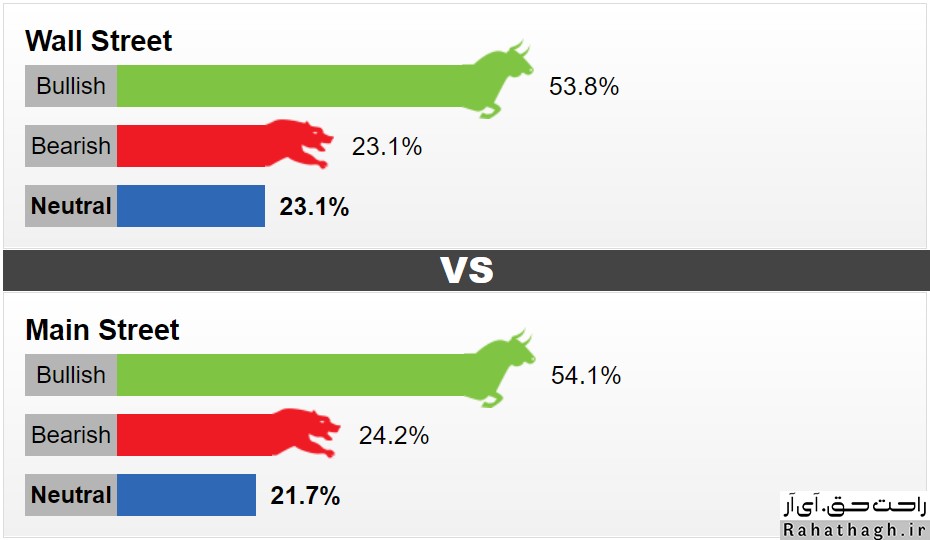

This week, 13 Wall Street activists took part in the weekly evaluation of the Kitco site. 53.8% predict that the global gold ounce trend will be upward. Another 23.1% predict that the market trend will be downward. The remaining 23.1% expect a trend-neutral or neutral market. 830 Main Street investors also took part in the online survey. 54.1% are in favor of an uptrend, 24.2% are in favor of a downtrend and 21.7% are in favor of a trend-free or neutral market.

Market experts comment on ounces of global gold

Marc Chandler is the CEO of Bannockburn Global Forex

"Momentum indicators are bullish and the price floor seems to be around $ 1773. If the global ounce price hovers above $ 1,800, the price floor will also be confirmed. In this case, the first target of the gold market will be the correction of 38.2% Fibonacci at $ 1820 and the 200-day moving average at $ 1833. "The yield on 10-year US Treasury bonds remains around 1.50 percent, and I think the price of an ounce of global gold will rise next week."

Colin Cieszynski is a market strategist at SIA Wealth Management

The activist believes that from a technical point of view, the selling pressures in the gold market are over. "I expect buyers to enter the market next week. "It seems that the uptrend has begun."

Adrian Day, President of Adrian D. Capital Management Company

"US Federal Reserve officials are not as prone to contractionary monetary policy as the Bank of America's interest rate announcement," he said. Many have also come to the conclusion that rapid inflation will take longer than initially anticipated and may not be temporary. That is why the gold market can offset the sharp downturn after the US Federal Reserve's interest rate meeting. "

Adam Button is a senior foreign exchange market strategist

"The global ounce price of gold has not been able to make a significant jump since the US Federal Reserve's interest rate meeting, while the US dollar has weakened and stock indices have risen. This performance of the gold market is worrying. I'd rather wait for the next few days. "If the global ounce price does not cross $ 1,800, it will be a sell signal for the gold market."

Jim Wyckoff, Senior Technical Analyst at Kitco

Vaikov believes that the price of an ounce of world gold has been declining over the past two weeks. In his view, it is difficult to get out of this downward structure, and sales pressures are likely to intensify in the coming weeks.

read more ...

Last week's analysis of Kitco site about gold

The upward trend in

The upward trend in