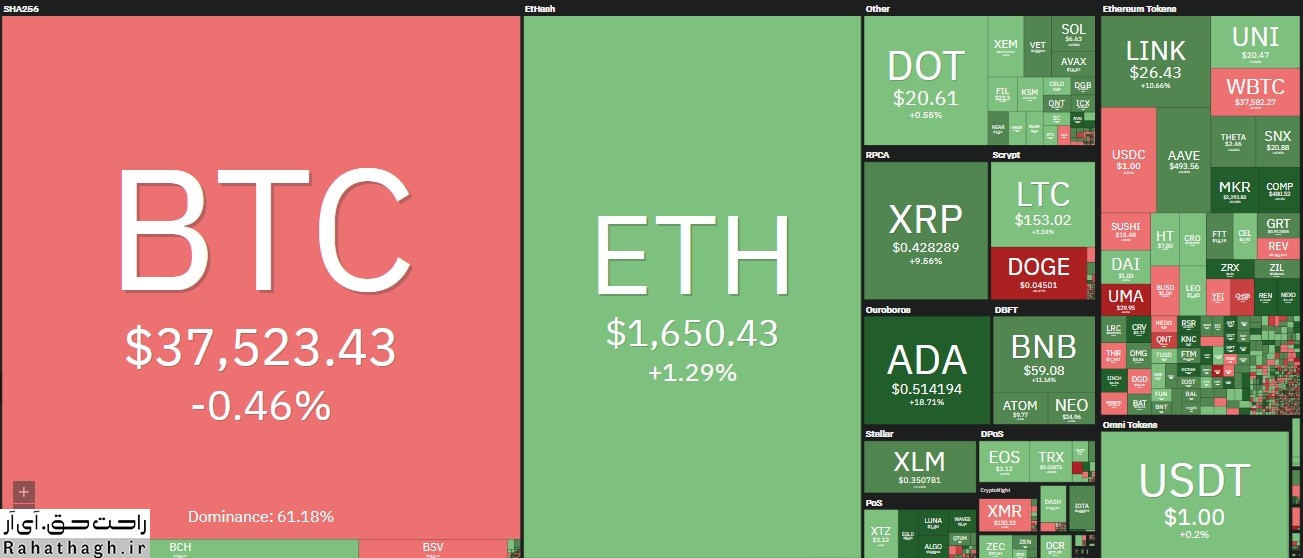

An overview of the cryptocurrency market today

After a tense day, the price of Bitcoin seems to have calmed down to around $ 37,500. However, its dominance in the cryptocurrency market is still declining and below 61% because several Altcoins have been able to perform far better than their leader.

Reduce Bitcoin dominance

While most alternative coins have seen significant growth over the past 24 hours, BTC has failed to grow significantly. The market's first cryptocurrency tried to move towards $ 39,000 but to no avail, reaching a low of $ 36,200 after being rejected.

However, the cows returned the asset to its current position of about $ 37,600. Similarly, the continued growth of altcoins has continued to reduce BTC dominance to below 61%, the lowest level since late November 2020.

Technically, Bitcoin must cross the resistance levels of 38000, 38800 and 39190 before challenging the $ 40,000 level. In contrast, support levels of $ 37,000, $ 36,000 and $ 35,140 could help if prices fall.

New records between Altcoins

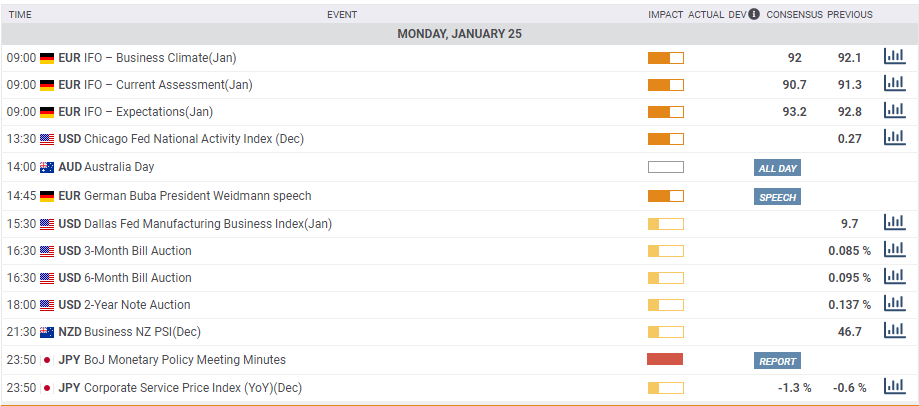

While Atrium (1%), Bitcoin Cash (1%), Polkadat (2.5%) and Light Coin (2%) have experienced slight declines in the last 24 hours, a number of Altcoins on the list are 10. Top market currencies have grown significantly.

Ripple and Cardano are leading the way with a 13% increase. As a result of these developments, XRP is again close to $ 0.45 just a few days after falling to $ 0.34. The ADA, on the other hand, hit a three-year high of about $ 0.50.

Binance Quinn and China Link have also broken new historical records. After jumping 9% in the 24-hour timeframe, the BNB rose to $ 58, while the 7% China Link pump raised the stock to $ 27.

As usual, lower market value altcoins have seen more volatility. Meanwhile, 0x is leading the way with 75% growth since yesterday and 130% price increase in weekly timeframes. As a result of this move, the ZRX has risen to $ 1.4.

Defy tokens including Maker (35%), Terra (29%), Ocean Protocol (28%), Ren (26%), Kyber Network (26%), Alpha Finance Lab (24%) and Synthetix (20%) Then fall.

The total value of the crypto market is still close to the $ 1.150 trillion mark.