Weekly evaluation of Kitco site from the expectations of gold market investors Tuesday, March 9

The strengthening dollar, the jump in Treasury yields and investor optimism about strong US economic growth have pushed down the price of an ounce of global gold. Kitco News 'weekly assessment also shows market participants' pessimism about the future of the gold market. Now the question that has occupied the minds of most market participants is how much will the rate of return on treasury bonds increase?

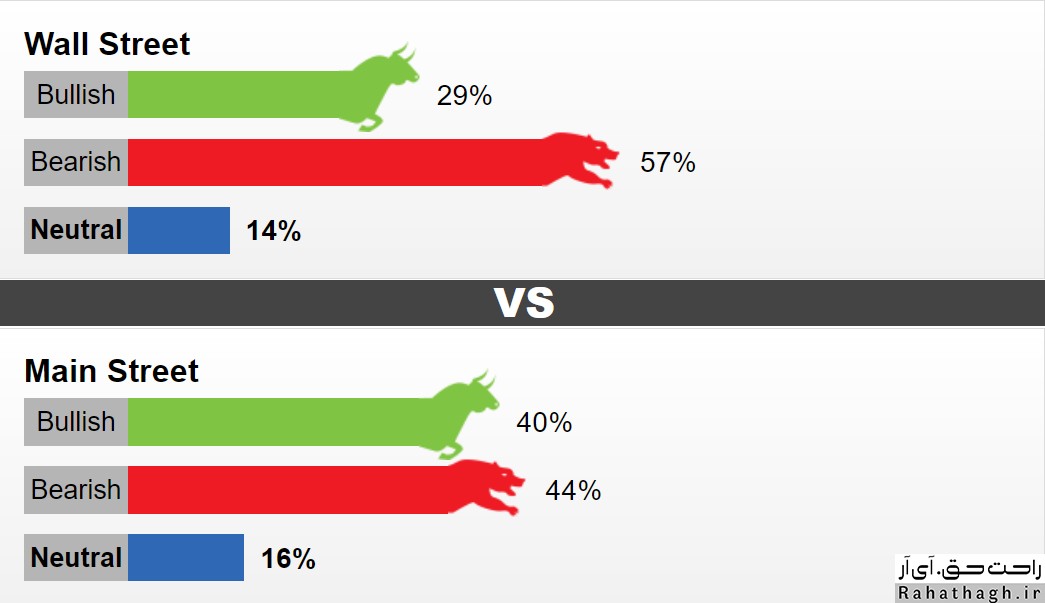

This week, 13 Wall Street activists took part in the weekly evaluation of the Kitco site. 29% predict that this week's trend will be an upward ounce of global gold. 57% predict that the market trend will be downtrend and another 14% expect the market to be trending or neutral. Meanwhile, 1,482 Main Street investors took part in the online survey. 40% are in favor of an uptrend, 44% are in favor of a downtrend and 16% are in favor of a trend-free market.

On Friday, the price of an ounce of global gold reached the support of $ 1680. The strong growth of 379 thousand NFP units was the main reason for the fall in the price of an ounce of global gold. US employment growth was much higher than market forecasts. Despite the fact that the price of an ounce of world gold rose from the price floor on Friday, XAUUSD ended the week in the negative range. As US economic performance improves, some analysts believe that Treasury yields could rise further. Especially since the US Federal Reserve has no problem raising the rate of return on Treasury bonds. The head of the Federal Reserve has said that raising interest rates alone is not enough to raise interest rates and exit expansionary monetary policy. It does not seem to matter to the US Federal Reserve what the rate of return on Treasury bonds is.

The views of gold market professionals

Phillip Streible is the senior market strategist at Blue Line Futures

"Whenever the rate of return on treasury bonds peaks, there will be a price floor in ounces of global gold."

Darin Newsome President of Darin Newsom Analysis

"The views of the head of the US Federal Reserve mean that the rate of return on Treasury bonds could rise further without the central bank intervening. "Increasing the rate of return on treasury bonds will put pressure on the price of an ounce of global gold."

Ole Hansen leads the commodity strategy team at Saxo Bank

The market activist expects the global ounce price to rise in the medium term. According to him, the price of an ounce of global gold has been able to maintain its support in the 11-month price floor. However, in the opinion of this professional activist, the challenges facing gold buyers are not over yet. "The price of an ounce of global gold will not rise until the yield on Treasury bonds and the US dollar reaches equilibrium. The Federal Reserve also has no plans to deal with rising Treasury yields. In other words, for the Federal Reserve to get involved, the country's financial system will face a significant increase in borrowing costs and will suffer a lot. "

Adrian Day, President of Adrian D. Capital Management Company

Adrian Day still hopes for an ounce of global gold, as long as fundamental issues support the price of an ounce of global gold. He believes that the strong growth of the dollar and the rate of return on treasury bonds will hurt the price of an ounce of global gold. "As long as the dollar trend and the rate of return on treasury bonds are bullish, the situation will be difficult for gold buyers. "At the moment I am just watching the situation and I will enter the market at reasonable prices."

Colin Cieszynski SIA Wealth Management Senior Market Strategy

The global gold ounce price will also be under pressure until inflation rises to significant levels, the activist said. He believes that other than gold, commodities are rising in price, which means that inflationary pressures will soon intensify.