Weekly gold valuation on the Kitco site Wednesday, March 31

The gold market continues to defend support at $ 1,700, but has not yet seen a strong uptrend. According to Kitco News' weekly assessment, the uptrend is almost the same, especially since the price of an ounce of global gold could not cross the key resistance of $ 1750. However, among professional activists, there have been slightly more supporters of the downtrend. However, many analysts believe that a drop in the price of an ounce of global gold could provide a good opportunity for long-term buying.

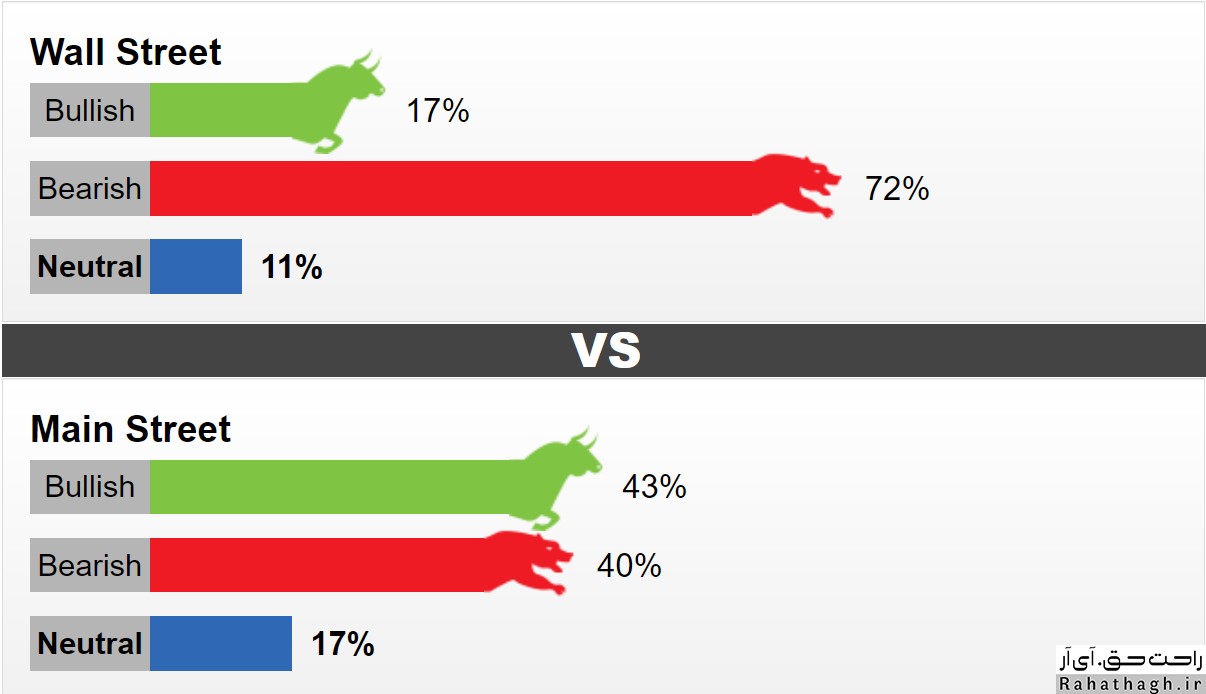

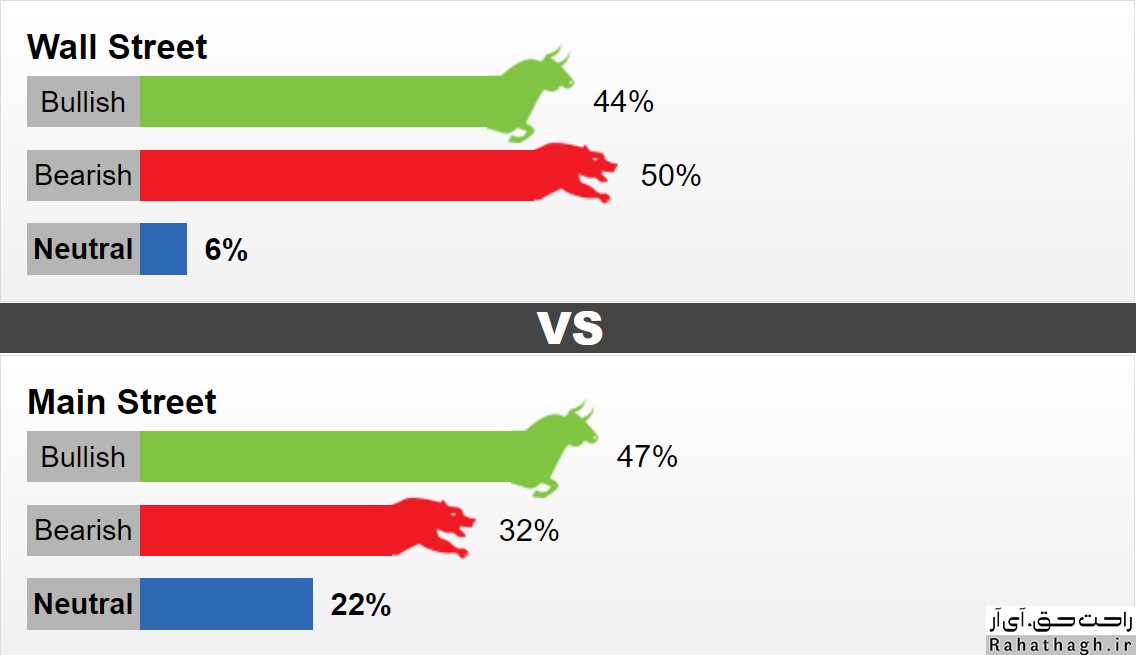

This week, 16 Wall Street activists took part in the weekly evaluation of the Kitco site. 44% predict that the global gold ounce trend will be upward. Another 50 percent expect a downtrend. Another 6% predict that the market trend will be neutral. Meanwhile, 807 Main Street investors took part in an online poll. 47% are in favor of an uptrend, 32% are in favor of a downtrend and 22% are in favor of a neutral trend. Although small investors are a little optimistic about the future of the market, it should be noted that the turnout in last week's poll has reached its lowest level since early May 2020.

The price of an ounce of global gold fluctuates between $ 1,700 and $ 1,750. For many traders, the ounce of global gold futures depends on the trend of the dollar and the yield on US Treasury bonds. US Treasury yields are near a one-year high.

The views of market professionals

Lukman Otunuga Senior Market Analyst at FXTM

"Rapid vaccination in the United States has boosted optimism about rapid economic growth in the United States and boosted demand for the US dollar. If the US dollar continues to rise, the price of an ounce of global gold will fall. Currently the technical situation of the market is in favor of the sellers. Closing the market below $ 1730 will push the price of an ounce of global gold to $ 1700.

Adam Button Leads Forexlive.com Strategy Team

Adam Button has also focused on US dollar fluctuations. "I do not think now is the right time to buy gold. There are positive signs of a growing US dollar. "The strengthening of the US dollar could be to the detriment of gold."

Jim Wyckoff, Senior Technical Analyst at Kitco

Jim Vaikov is the only market analyst who expects a trend-free or neutral market. However, in his view, the market is a bit downward.

Charlie Nedoss Senior Market Strategy at LaSalle Futures Group

The activist believes that as long as the price of gold is above the moving average of 20, he is optimistic about the future of the gold market. The average is around $ 1725. "If the world ounce price of gold can keep the 20-day moving average, we can expect the price of gold to rise above $ 1,750." According to Nodos, the yield on Treasury bonds and the US dollar may have peaked in the medium term. This means that in the medium term, both bond yields and the value of the US dollar will fall and the conditions for the growth of an ounce of global gold will be smoothed out.

Daniel Pavilonis Senior Market Strategy at RJO Futures

This professional activist is optimistic about the medium-term trend of ounces of global gold. According to this professional activist, pessimism about the future of the market has increased and this may be a good opportunity to start buying gold.