GrayScale buys $ 709 million in bitcoin and atrium in less than a month

In recent weeks, Grayscale has added millions of dollars of Bitcoin and Atrium to its digital currency portfolio.

According to Bybt, the institute added 7280 bitcoins worth $ 348.28 million and 240,000 atriums worth $ 361.5 million to its total assets between February 1 and February 26. In total, Grayscale increased the value of its GBTC and ETHE funds by $ 709.2 million this month.

Bybt data show that the number of Gayscale bitcoins increased from 648470 bitcoins on February 1 to 655750 bitcoins on February 26.

Also in the Atrium Fund (ETHE), assets rose from 2.93 million atriums on February 1 to 3.17 million atriums on February 26.

This Grayscale investment brings the total value of the assets managed by the institution to $ 35.38 billion.

By 2020, assets under the management of the Grayscale Bitcoin Trust will increase from $ 1.8 billion to $ 17.5 billion.

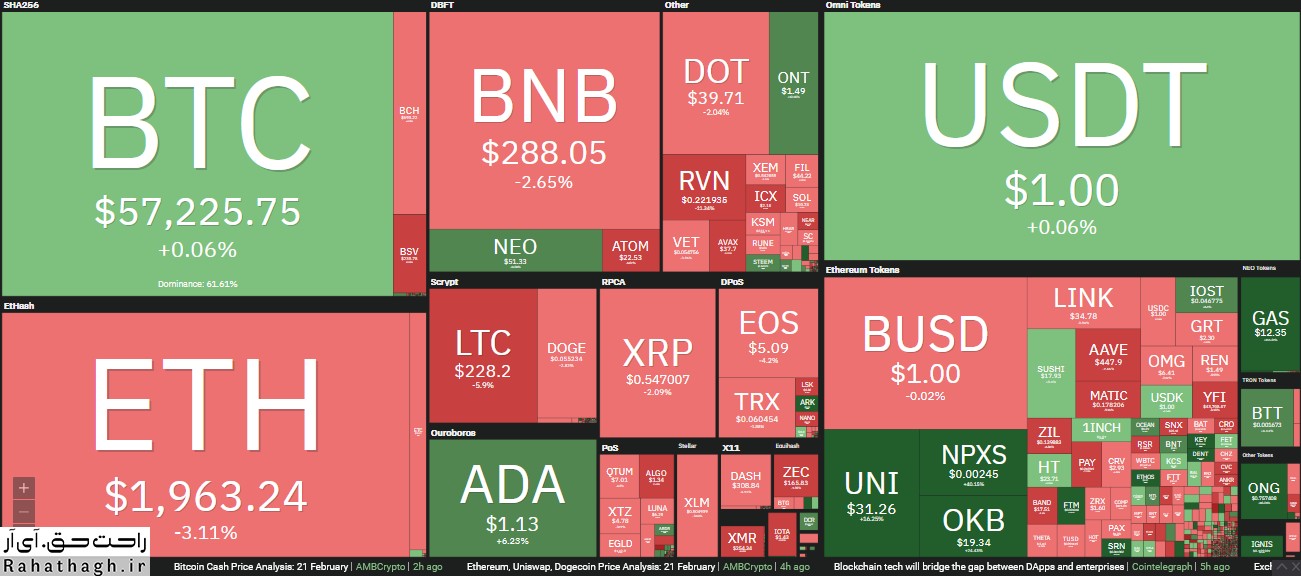

While Bitcoin and Atrium are the institution's largest portfolio assets, other funds use cryptocurrencies such as Litecoin (LTC), Bitcoin Cash (BCH), Ethereum Classic (ETC), Zcash (ZEC). , Horizen (ZEN), and Stellar (XLM) are also available.

In addition, in January, the institute announced the registration of other altcoins. These assets include Aave (AAVE), Cardano (ADA), Cosmos, (ATOM), EOS (EOS), Monero (XMR), Uniswap (UNI), and Polkadot (DOT).